Andre Schneider

Reasons why the Financial Markets Will correct to what they should be valued in 2018, if this doesnt occur, it will be because a great ammount of money will be printed in order to sustain the stock and debt markets a Little longer.

The most important thing to understand before Reading this is that what we know as “money” is actually just paper that is not backed by anything, but only the confidence of lots of people that tomorrow they will buy something with that cash.

*this is the case in all the world

Dollars are a representantion of debt, in order to create dollars, the Government must ask for a loan from the “FED” which will later be paid by the Governmert with more interest, this is the reason the national debt will keep going up.

There is a catch, the national debt is too high and from what i understand only the interest payments can be made, without negatively affecting the markets.

It is like what we see in 2018 in the credit card debt, which surpasses 1 trillion dollars (1,000,000,000,000 USD) as I write this article. Consumers (americans) that are in debt, are paying the mínimum and postponing that debt, just as the National government.

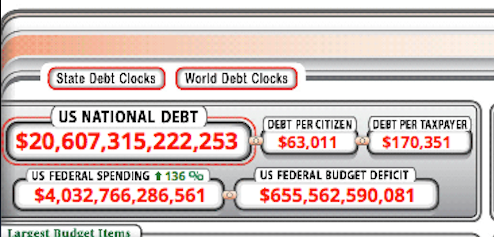

As of January 14th, the debt was at nearly 20.6 trillion. Which from my calculations will grow at a faster rate this 2018 than the Real GDP of the American Economy.

*I state “real” economy, because when stating GDP in some websites they dont take in account inflation, which in the antithesis of growth.

The article starts here:

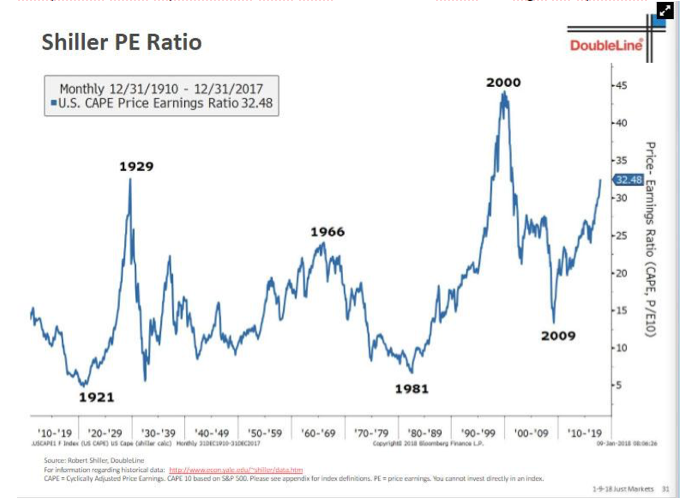

Price to Earnings and Price to Sales! Price to earnings are high because some companies have repurchased their own shares, and other are high on optimism.

data taken from Jeff Gundlach “doubleline”, as we can see, we are higher than the average which could be at 15. Higher than 1929 and 2008, but not 2000.

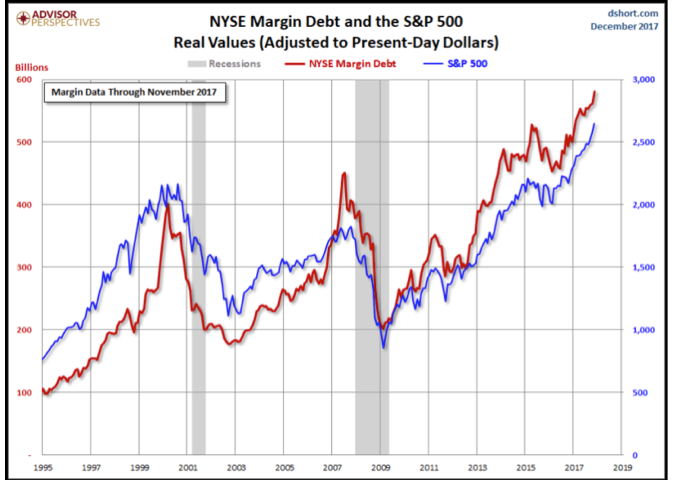

Margin Levels are very high. Investors are very leveraged, in comparison to other years.

Normal margin is maybe near 300 billion dollars, but now we are @550 bililion. More investors are leveraged, that makes a downturn risky because people get margin calls and have to sell positions at a loss.

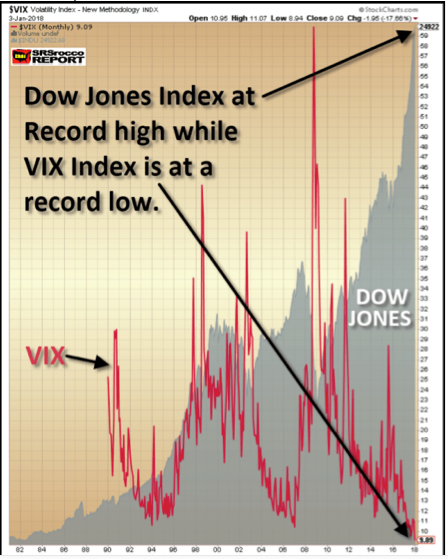

The VIX, or the Volatility index has been below 10 dollars to much time in the recent days, The vix is a measure of the sentiment of the options traders, the more bullish, the lower the Vix, the more bearish, higher vix.

*The FED recently admitted that they held in the past (who knows if they do still) a short Volatility trade.

• Hard data is bad, while soft data is very good.

*Hard data means factual data, from evidence, and soft data is expectations from the market conditions.

The reason why lots of stocks are high is because of the Federal Funds Rate. Which is now in the 1.25% to 1.5% range. This makes it posible for companies to get cheap money (at a low interest rate) and invest in the markets.

Or in the case of some companies, to buyback their shares and make the P/E ratio look a lot better although net income may be the same as last year.

Central Banks are buying US assets, such as the Central Bank of Switzerland.

Another place Where central bank buying is making a headline is in Japan, where the Bank of Japan (BOJ) buying a lot of the ETF’s in the country

*its not a main reason, but it has a certain influence.

*ETF’s are extchange traded funds, which are funds of something, sometimes tracking a commodity or sometimes a group of companies.

In 2017 central Banks of the World purchased approximately 2 trillion of financial assets. In order to keep interest rates low, because if they go up. The stock market crashes. (im not talking of .25%, but if they go to 3%) or more.

In 2017 the interest on the debt was nearly 250 billion. (250,000,000,000)

At 3% FED funds Rate, the cost of paying just interest on the debt is 640 billion.

And 640 billion is a big number, considering the US had a comercial déficit of 500 billion in 2017. Many will argue it is bad for America, but in reality trade déficits are very good in my opinión, because the US is paying for international goods, with paper that is not backed by anything. (the dollar). And it also creates a larger market usage for the dollar, because the dollar is the reserve currency of the world.

What I have read and feel bad about some people, is that they have taken loans using their home as collateral, this i see very bad because in the downturn the home prices will go down, but the ammount they owe will be the same. What that will cause is that when the markets go down, the Banks will own a lot of real estate.

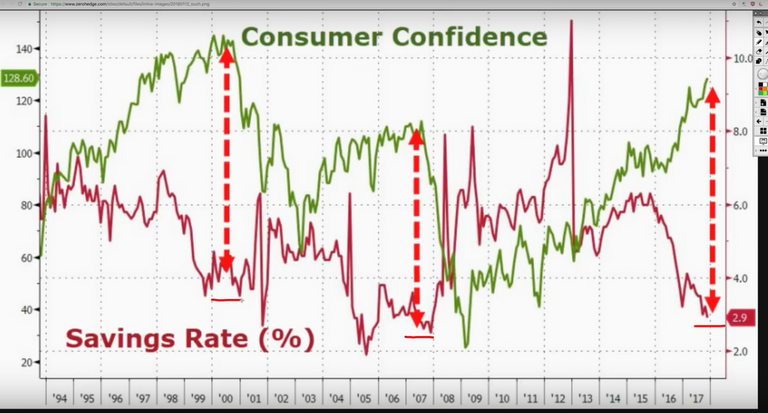

Savings rate is low, as in 2000 and 2007, and people are too confident.

Fed has said they will start unwinding(start selling), their balance sheet, it will have to be too slow because it has a very large impact on the market. Right now they own 4.5 trillion dollars in Mortgage backed securities (houses from the 2008 crisis).

Supposedly they would start selling their assets in October 2017 but it didn’t start as planned, I think till the date they have only sold 10 billion usd approximately.

Student loan as one of the biggest assets of the US government, im not sure if it still is.

I believe that in many funds hold in some percentage student loans, which account for 1 trillion dollars in debt. This means that some pension funds are the ones that get paid, when students pay their debt off.

The dollar will loose purchasing power, like in 2017, in which the DXY (the dollar index) lost 10%. Which will mean more inflation for inside America, nothing big, but more inflation for the day to day purchases.

I believe the market can keep going up and most probably it will, because if the market goes down, it wont be like 2008 in which companies recovered quickly, this crash will make things a lot harder. Because there is doo much debt to be serviced, actually the world debt is 333% larger than the World GDP.

I feel that there is too much risk to the downside, in comparison to the upside gains that can exist. Since trump got elected 7 trillion has gone into Us stockmarket. And the Dow is nearly up 30% since November 9th 2016.

One of the important facts

Is the idea of a “bond bubble” in which Bill Gross is a fan of. The idea is that people will start selling bonds and yields will go up.

The reason why the bond selling may start is because they are paying low yields in comparison to other assets, and Central Banks have made the bonds go up a lot in price,making the yield lower in order to promote more activity in the American Economy.

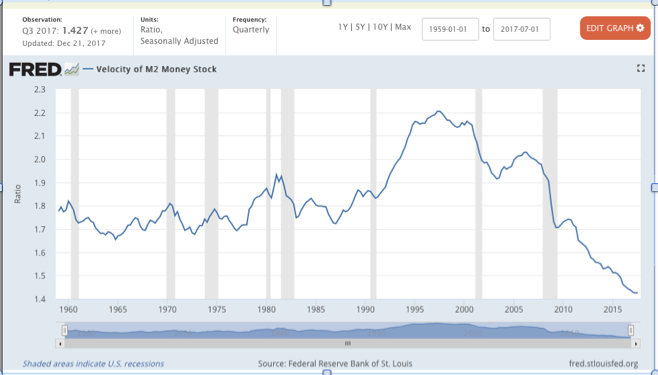

What I write here, can be confirmed, looking at the money velocity chart from the FRED,

What this shows is that money is circulating in America the slowest in maybe like 60 years… The reason why it hasn’t shown a lot in the economy is because of the great amount of money that is pumped by the central banks to keep the markets high, for now.

These are all the reasons why I believe Gold, and especially Silver are a good investment in the coming months, because they don’t represent a liability to anyone, and at one point people will seek safety and that will push prices a little higher.

Actually the people who give value to Gold are China ,Russia and India, they have been buying lots of Gold. And it is my opinion, that at some point in the future, gold will have a larger price in dollars because of its view as a safe haven.

Although I believe silver is a better bet in the precious metals, because the gold to silver ratio indicated thtat for every 80 ounces of silver you get one gold coin, while extraction on earth is nearly 10 to 1. And silver demand in the world is slowly growing, while silver supply is slowly going down.

Also an important factor is that nearly 360 billion ounces of silver are traded each year, while only .8 billion are mined every year.

It is maybe similar to what the banks do with “fractional reserve lending” in which if everyone wanted what they believe they own, they wont get it.

I am also a proponent of cryptocurrencies, I actually own some since May of 2017 and have made some dollars there. The reason why I believe in Bitcoin and some other cryptocurrencies is because they represent mathematical work that can’t be reproduced or fraudulently made.

Bitcoin for example is a deflationary currency, which means it cant be inflated. There will only be 21 million bitcoins in human history and bitcoin mining in 2017 used more energy than the whole country of Ecuador. I say that it is deflationary because every day there needs to be more dollars in existence than yesterday, bitcoin isn’t that way, and investors seeking a safety from Fiat currencies go into Gold, Silver and Bitcoin. They represent no debt to anyone.

*one thing to notice is that bitcoin, just as the dollar, has no value, and it can go to 0 dollars. But my personal opinion is that 1 bitcoin will be valued at 500,000 dollars in 2022 approximately.

In summary its not to be negative but there are many bad indicators in the market now, maybe in the future, after a 40% correction it may be a good idea to purchase some high quality stocks.

*in a more long term perspective, other countries are trying to trade oil in their own currencies, and at one point they will be able to. This is a big threat to the dollar, because if that happens, the 1,700 billion dollars that are traded in oil every year will be traded in another currency.

Maybe bitcoin, maybe the yuan or maybe gold.

This is big, because it will make US imports more expensive, but labor market inside the us will start production as it was in the 50’s due to a cheaper labor.

I made this because I was speaking to my dad last night and he told me what would I think about making a summary of the stuff that I have been reading off the internet, and thought it was a pretty good challenge. I hope you find it interesting. Everything was written by me, but the graphs and images I took from other webpages where I read the information from ☺

This is me at the Mexican Stock Market Exchange “BMV” (Bolsa Mexicana de Valores)

)

)