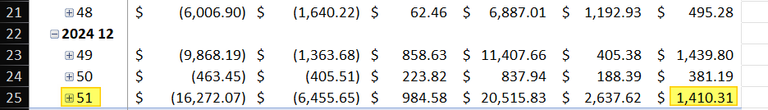

2024 Week ending Summary - week51

- Summary

- Big moves, big winners or losers

- Offsetting Positions (Hedging)

- Defensive Trading

- New Opportunities

Summary

This week was a difficult week for most traders.

Dow is down for the last month (3 weeks down and was on a 10-day losing streak). That losing streak was the longest since 1974 (Sept 20-Oct 4).

S&P is flat if you look back 30 days due to the big DROP on Dec 18.

Nasdaq is up about 3% if you look back 30 days.

Big moves, big winners or losers

As an options trader, big moves can mean one of two things

- big gains

- or big losses.

In options trading, much of it is based on "expected average moves" over a certain time frame. When the market experiences a 3% drop in a single day or a 1% gain in a single day, you can either make substantial profits or suffer losses quickly.

Excluding the dividends received in week #51, I made about $425 from the option trades. This was not a bad week for me. However, I might still be in a tricky position with some holdings.

For example, my AMD Put credit spreads are currently under significant pressure, resulting in a losing position. I need AMD to trade above $135-$140 to resolve this issue. While the drop in AMD has caused my AMD-covered call to be in the money, I need to ensure I don't overreact on the call side and limit my upside if AMD rebounds in the next three months.

Offsetting Positions (Hedging)

This week I shared about my GILD position and explained why I did the moves I did.

- My Covered call is DEEP In-the-Money (ITM).

- My existing Put Credit Spread was making money from Time Decay.

- I extended my PUT credit spread out to Sept 2025.

- I rolled up my Covered call to a $80 strike price costing me $78 (cash out of pocket).

- I potentially gain $250 per contract (x2) if GILD stays above the $80 strike price.

- This position adjustment cost me $19 out of pocket; to gain $500 in value today.

My investment method does not NEED extreme moves in either direction to make money. I prefer market stays in a tighter RANGE between -15% to +15% a year. The last two years of over +20% gains have limited some of my GAINS from options trading because of the number of days that was greater than the EXPECTED MOVE (that I mentioned in the previous topic).

Defensive Trading

As the year ends, many traders like to move into a defensive mode to "lock in the gains" for the year. In one sense, I did the same by adjusting my position to remove some of the risk going into the last two weeks of trading. If I lose 17K, I would have MADE nothing in all of 2024. So I might have adjusted some positions earlier than I normally would have done (to remove some of the risk).

New Opportunities

On the other hand, this year I made it a point to sell off DIVIDENDS that I received and then buy into 3 different areas:

- Nasdaq 100 Index (QQQM)

- Bitcoin (or Bitcoin Proxy).

- New Position in Small/Mid Cap names or Special Conditions (WING/ PLTR / etc).

The objective was to steer clear of safe dividend businesses, despite my preference for them. I already have ample holdings that generate income and dividends. I've utilized these dividends to fund new purchases, demonstrating that most people don't have $20K or $50K annually to invest in new positions.

Over the past five years, I've added approximately $7K per year into new investments from my W2 income. I hadn't contributed new money to my ROTH IRA for over a decade until about two months ago. I spotted several promising opportunities and decided to make some sacrifices to fund the ROTH IRA.

As the year comes to an end, I will be writing a Year-End Summary and what I learned and what adjustments I will make for 2025 and beyond.

If you are new to earning while posting content, you should look into blockchain-based social media platforms. I believe they offer a better solution than FB/X for the average user. If you are already on inleo/peakd, don't forget to like or comment on my blog.

https://inleo.io/signup?referral=solving-chaos

Have a profitable day!

Posted Using InLeo Alpha