First it was Goldman succumbing to hedge funds and "due to popular demand" providing its first ever "technical" take on where Bitcoin will go from here. Now it's Morgan Stanley's turn.

In a report on the "Blockchain, Unchained" - in which it advocates for regulation of the blockchain as part of its evolution as well as providing a "master key" to a regulator, in effect killing the very premise behind such a decentralized infrastructure (more on that later) - Morgan Stanley writes that "the rapid appreciation of cryptocurrencies has elicited many inbound phone calls to both our banks and tech teams."

It responds that possible explanations for the dramatic moves include investors in search of uncorrelated risk assets and technologists looking for incremental security. But, the bank writes, "governmental acceptance, would be required for this to further accelerate, the price of which is regulation." We doubt many supporters of cryptos will agree with this.

In any event, here are some further details from Morgan Stanley, but first, a quick primer: as MS explains, for many, Bitcoin and blockchain are often thought of synonymously. In reality, blockchain is primarily a messaging and bookkeeping method, whereas Bitcoin is a store of value that makes use of blockchain methodology to transfer value. Bitcoin and other cryptocurrencies have shown rapid appreciation, as shown in Exhibit 23 and Exhibit 24, with the pace of appreciation showing rapid acceleration since the beginning of 2017. While Bitcoin grabs the headlines, Ethereum, another cryptocurrency that attempts to address some of the echnical shortcomings of Bitcoin, has been gaining value at an even faster rate. The rapid appreciation of blockchain-based currencies and the proliferation of new cryptocurrencies is further raising blockchain’s technological profile.

MS then gives a detailed "explanation" on why Bitcoin and other cryptocurrencies have appreciated rapidly, saying "key possible drivers of cryptocurrency appreciation. It is not clear why cryptocurrencies are appreciating so rapidly (apart from the appreciation itself drawing in more speculation against a potentially inefficient ability to sell). But, in conjunction with our FX Strategy team we identify several key potential contributors:"

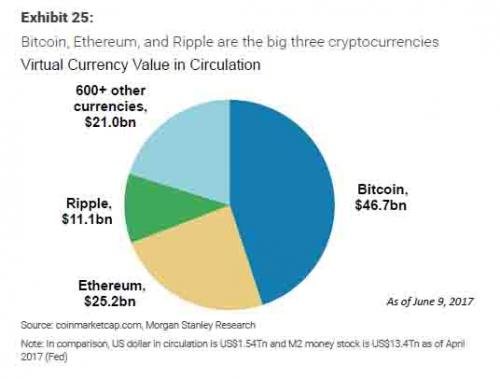

ICOs—initial currency offerings. Rapid appreciation of cryptocurrencies is encouraging speculative formation of new currencies (see Exhibit 25 ). Many of these new currencies don’t actually have use cases yet, but are intended to be exchange mediums for everything from virtual goods in games to banking mechanisms for products like marijuana where legal implications are not yet fully clear. ICOs are funded with existing cryptocurrencies, hence driving an appreciation circle—e.g., to support/invest in a new currency, one must buy and trade an existing cryptocurrency.

Moving funds in China. Up until the last few days, a disproportionate share of Bitcoin mining was taking place in China (where there is cheap access to servers and cheap electricity). First on this website in 2015, and subsequently on many other outlets such as the Wall Street Journal (November 5, 2016) and Fortune (January 5, 2017) have noted that Bitcoin was being used to help avoid monetary controls in China, which explains why the Chinese government has cracked down on Bitcoin mining recently.

Increased demand from Korea and Japan. Bitcoin appreciation seems to have been heavily driven in recent months by increased buying from Korea and Japan. In Japan, the recent legalization of Bitcoin has led to an increase in activity, including the recent opening of new Bitcoin exchanges. In Korea, however, there is not a clear explanation for the surge.

While there is no one specific explanation for the surge in cryptos, Morgan Stanley is surprised because the rapid appreciation it taking place despite clear hurdles, to wit:

The rapid appreciation of Bitcoin and others is somewhat surprising in light of some developments that seemingly would have put downward pressure on the currency, including plateauing trading volumes (see Exhibit 23 ), the SEC’s decision not to allow the listing of a Bitcoin ETF, and China's shutdown of several Bitcoin mining operations (without those miners, transaction time for Bitcoin could increase substantially)."

MS then notes that bitcoin, ethereum et al, are acting more like an asset than currency.

Most regulators and investors view cryptocurrencies more as assets than actual currencies. Their values are too volatile and too hard to actually use for payment for most to consider them currencies. Our conversations with some merchants indicate that, while cryptocurrencies might actually be attractive for them to operate their businesses, they find that the cryptocurrencies are far too volatile to be used.

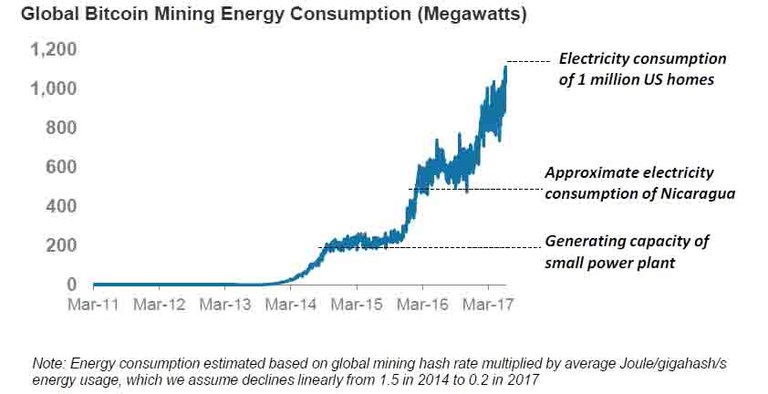

MS slams Bitcoin which it reminds clients scales poorly, helping alternatives (especially those based on Ethereum). The blockchain underpinnings of most cryptocurrencies scale too poorly for most currency-like uses. Scaling challenges includes increasing electricity consumption as shown in the chart below, and that time to clear single transactions can often be from 10 minutes to more than an hour, and even that with no guarantee. Ethereum and others have addressed those scaling challenges by centralizing more of the blockchain function, although such increased centralization leads to increased hacking risk, as Ethereum found out the hard way last almost exactly one year ago.

Finally, going back to the most controversial point in the report, according to Morgan Stanley further price gains in cryptos may not be possible unless the they agree to regulation, and giving up some of autonomy. Which is ironic because as Ryan Vlastelica writes, "proponents of the digital currencies frequently cite their decentralized nature as one of the primary attributes that excites them about the technology."

Morgan Stanely didn’t specify what types of regulation might be necessary to further push bitcoin higher, noting that the specific changes needed may be different for different cryptocurrencies, all of which use blockchain technology. For blockchain overall, “regulators are involved and watching closely,” Morgan Stanley writes.

“Some have suggested privacy could be improved. Regulators are looking to have a master key so all transactions are visible to them.”

And while handing a master key may indeed streamline costs, it would likely also sacrifice Satoshi Nakamoto’s original intention of blockchain technology, which was to put banking inside the hands of the individual.

In the White Paper, Satoshi said, “Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model.”

This is what Satoshi’s envisioned, but it remains to be seen whether Morgan Stanley’s idea of the master key in blockchain technology will trump the idea of bypassing third parties. Some in the ecosystem still hope Satoshi’s original vision will prevail in the end. Others, those who hope for further gains in the price of bitcoin, ethereum and others, may be willing to sacrifice decentralization if it means further gains. For now, the jury is out even as both bitcoin and ethereum continue to trade just shy of their all time highs of $3,000 and $410, respectively.

Source : ZeroHedge

---------------------------------

For only the best of ZeroHedge and articles relating to Steem, Follow me @Zer0Hedge

Thank you, very informative article! Need to be aware of thoes things!

Thanks. very interesting information

FUCK THIER MASTER KEY :0

Great Share! If I read the entire thing it had to be filled with some needed information. Thank you for the insight and heads up^.

They cannot deny that there is a huge market.. It is legal in Japan in many countries.

They just have to let Big brother figure out how to get their hands in the cookie jar, then we will have permission to be free---ishhh.. Never ending saga continues! I hope the crytpo's do not give in...

Thank you very much. Lots of value you here my friend for laymen to the Banking industry.

HAVE A GREAT DAY!!

Is this the official zerohedge steemit account or just a copy and paste? Can't see on your profile.

Master key? Really? Who do they think they're fooling. Do that and cryptocurrencies die!

I smell an assassination attempt

Very enjoyable post, and informative!

I can't help but think of this when I hear about this "master key" malarkey.

Don't care about the MASTER KEY.

Excellent read.

No key for you!

Some very interesting information.

Very interesting and well-informed article.

https://www.tradingview.com/x/kjkVjLh6/

symmetrical shorting in 1H segments..looks oddly similar to banks & hedgies shorting biotech small caps to set up big buys

http://imgur.com/a/ChmNS

Best ARTICLE ABOUT CRYPTO

MUST REMEMBER THAT TECHNICAL ANALYSIS IS KEY TO SUCCESS

Nice Posting! Just upvoted and followed you, if you want me to resteem this post or have any other posts that is valuable to humanity and want to spread the word please let me know :)

i dont have interest in bitcoins anymore

good article

The good thing about Crypto currencies is that anyone with a good concept can create their own coin/token. If Morgan Stanley get a Master Key to Bitcoin, then BTC will die and a new coin will take its place.

Just as the fiat DIGITAL debt currency (USD, EUR, GBP, blah, blah) is already being overtaken, by BTC as institution mega big funds find somewhere to hide their own vast shrinking Digital wealth.

I say BTC's real value is its decentralised and private way of transferring wealth. Current fee's are killing BTC at the moment and if any of the coming changes improve BTC's usability it will go to another level.

Looks like the megabanks and large hedge funds are running scared of cryptocurrency to the point that they are throwing random things at the wall in hopes that something will stick. But this does not surprise me since the overall market cap has increased tenfold in the matter of a few months. On top of that, bitcoin has lost its monopoly in the crypto market. In fact, any day now the ETH and BTC market caps will meet. This will make it even harder for them to regulate. Moral of the story: buy ETH/BTC as they have proven to hold their value better than fiat.

https://www.mediastorehouse.com/p/497/we-demand-a-new-deal-american-cartoon-8244283.jpg

I know I'm getting calls and text from friends and family constantly right now.. Thats part of the reason I wroth this: I will never sell again… what I have learned about crypto since 2013