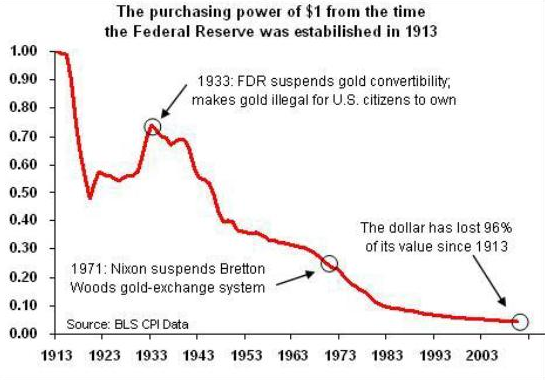

Well thats a very nice little story. Unfortunately it is based on flawed Keynsian logic. The government’s interference in the monetary supply has almost always had negative effects on the economy long term. Take a look at the purchasing power of a dollar since the federal reserve act of 1913.

And then even if your anicdote makes sense in theory, it still assumes that the federal government is made up of people competent enough to centrally operate what is bascially a global currency. Thats a big assumption, and likely an inaccurate one based on the track record of governments.

Sound Money>Stable Money