.jpg)

So it’s April 20th, 2019. You’ve seen bitcoin and cryptocurrencies swing violently up and down for a few years now, but you (the audience I’m speaking to), have not yet dipped your toe into the space.

First give me a second to hold back my internal screams of “Why?!”…(or rather, Why Not?!)…

Okay.

I’ve been into cryptocurrency since 2012 and yes, I do admit, I am quite tech savvy and some could argue addicted to computers and analyzing the impact of technology upon society. I’m also Libertarian leaning, so its a perfect match for me to be one of the crypto spaces early adopters. It’s too bad I’m just not a multi-multi-millionaire right now, but we live and learn.

For your average person, bitcoin is a mystery. A digital currency, but an enigma, some see it’s power, some do not. But if you’re reading this, believe me, you are NOT the average person anymore. You are somebody ready to learn and no longer putting off the inevitable.

Now let’s get on to my 5 Reasons NOW is the best time to get into cryptocurrencies.

Reason #1: It’s here to stay.

Bitcoin is now 10 years old. The world wide web was invented in 1989. Bitcoin is like the internet in 1999. Now of course technology seems to move faster these days, but imagine missing out on the internet in the 1990’s…what could be worse? What could be worse is continuing to not see the internet for it’s inevitable staying power and explosive potential IN 1999!

Compare this to another technology; the smartphone. The iPhone did not exist 12 years ago. I repeat that: The iPhone DID NOT EXIST just 12 years ago. The space of cellphones and how people use them is dramatically different in 10 years difference.

Imagine being able to directly invest in the internet as a whole in 1999.

Reason #2: It will grow fast BECAUSE it’s hard to regulate.

Let me bring up my electronics example again. A space of invention requiring incredible ingenuity and expertise; the building of increasingly smaller and more functional devices in a space you can argue has minimal government regulations has had an incredible boom in production and adoption. Just think of how fast TV’s went from standard to High definition and from High definition to Ultra-HD, 4K, HDR, flat panel, OLEDs, curved screens, smart features, voice controls and more. We went from Cable to DVD to Blu-Rays and now online streaming services. Government, not having the technical-knowhow to micro-manage this industry (and I’ll admit, it also not having as much of a threat to their power, that they perceived) allowed it to burgeon rapidly. I could imagine a world that in a few years nursing homes will have tablets for guests to play solitaire or chess or watch videos on.

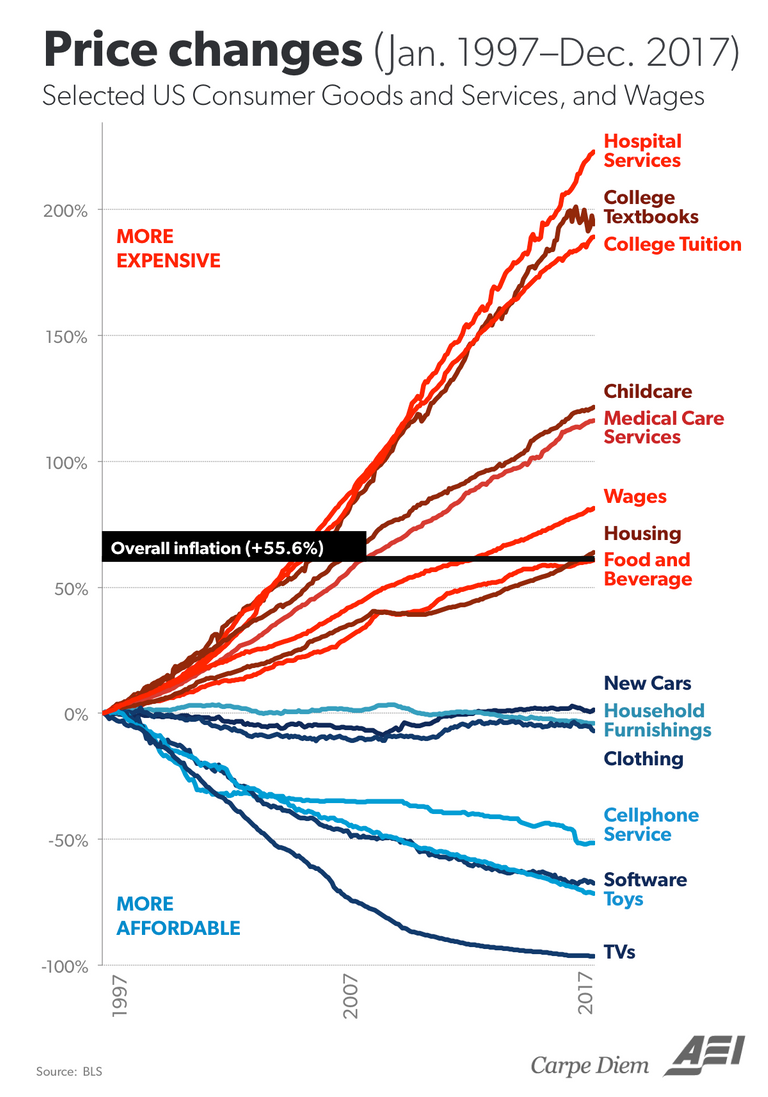

Notice how far prices have dropped in electronics allowing mass adoption in an era you can argue wages were stagnant and standard of living growth questionable, flat or even negative:

Now think of bitcoin. A decentralized open-source internet based currency that people can transfer person to person. It IS cash for the internet, both anonymous and he who holds it owns it; untracked and tied to your name unless you choose to use the services that require such information. Like anything else so large and pervasive, most transactions will be fully legal and regulated, but there will be those that aren’t. Government needs to allow bitcoin to grow because they want as much taxes as possible. They want the legal cryptocurrency realm to exist so that the people do not revert to their natural freedom seeking tendency and tax avoidance. It is incredibly complex however, and those with the expertise to understand enough about it to even begin to control it are going in the for-profit sector, not government.

Reason #3: We’re 40% down from 1 year ago, 72% down from the peak.

%20575x380.jpg)

Let’s review reasons 1 & 2: It’s here to stay and government is not shutting it down. Combine that with the fact that it is 40% down from a year ago and 72% under it’s high and we’re showing signs of the bull market resurgence. Bitcoin has continually held the floor and key psychological level of $5,000 for two weeks.

CoinDesk’s Omkar Godbole said on April 19th: “Bitcoin could challenge the recent high above $5,450 if sellers again fail to keep prices below $5,200.” And here we sit on April 20th at over $5,300.

Reason #4: We’re still up over 300% from 2 Years ago.

Can you believe it? There are only more and more uses for digital currency. There are only more and more users. With a hard-coded limited supply, the price (and market value thus) must go up. It MUST! Needless to say, bitcoin is the indicator of entire cryptocurrency market which is currently valued at $180 Billion.

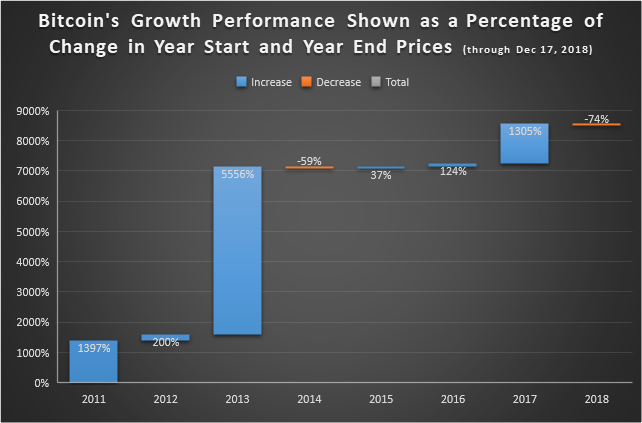

When bitcoin crashes, it crashes, when it explodes it’s a rocket ship launching off like no other:

Reason #5: It is tremendously undervalued compared to it’s still untapped use cases

It is a system that can facilitate the whole world’s financial transactions; crossing borders for governments and people alike. The use cases are infinite. Blockchain technology can be used for so many different aspects of our lives. We can timestamp document real estate deeds, medical records, communication and much more in a space saving, efficiently distributed manner. Basically, it’s the greatest thing since sliced bread. And when blockchain gets more uses, bitcoin gets more investors; simple as that. A censorship resistant worldwide store of value alone would be an incredible investment, but the fact that cryptocurrencies provide nearly infinite potentially more than that was just unfathomable for the world 11 years ago.

Don't be shy, JUMP IN!