I do not believe in a "portfolio" strategy for crypto trading for the reason that the creation of an efficient portfolio implies access to various tools differ in the level of risk and return. If the last really varies widely between different script-active, it is quite difficult to find ones that have as varying levels of risk and different financial essence of the traded instrument.

In particular, the main problem of any portfolio of the Fund on the blockchain — this is an unprecedented correlation between States of all possible scriptaction. This, in prit-snipe intuitively you can see the schedule: if begins to «swing» Bitcoin or Ethereum, it certainly affects on all altcoins.

There are several reasons:

• Bitcoin and Ether are used as a proxy currency: you can't invest in ICO or withdraw in Fiat NOT using these two.

• Trading altcoins 98% of trading to BTC/ETH, and accordingly, the profit to this proxy currency. The capitalization of the individual project is denominated in dollars without reference to the exchange rate of BTC.

• Almost all ICO projects have similar structure risks for investors, tokens of different projects are interchangeable from the point of view of the weight in the portfolio.

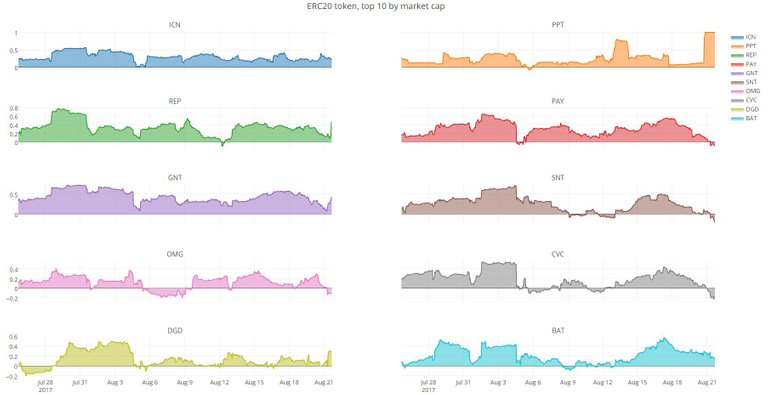

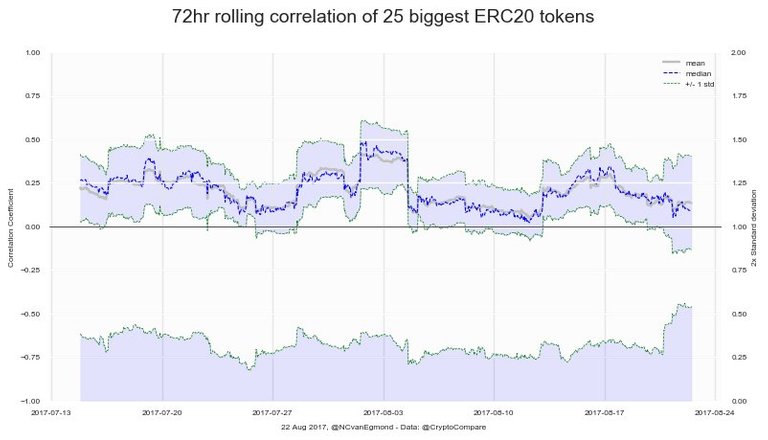

Above graph shows the correlation of the top-10 ERC20 token is possible with the naked eye to notice the obvious connection. The second graph shows a General correlation of all tokens (-1 is an inverse correlation, and 0 is no correlation, 1 – correlation)

My thesis is that this kind of dependence of the assets from each other and also shows the essence of their trade, but — more importantly — the fundamental cause of the pricing script-active. Namely, the almost all successful crypto projects (except Bitcoin, which can be considered a functioning and self-sustaining organization) today are something of startups at the stage of pre-seed/seed, that is, either preparing to serve or already have a ready prototype of their product, but, importantly, not more. This could include all the famous crypto projects (not currency): Gnosis/Augur, Steemit/Akasha, Storj/Filecoin, Civic, EOS, Brave, Golem/SONM, IOTA and the list of your favorite tokens, including, by the way, Ethereum, which the developers each time striving to remind the community that even if it is not a prototype, but clearly not the release version.

Thus, the following analogy can be traced between markets script active and traditional start-ups: an investor with a portfolio of tokens is something like LP venture capital Fund with the risk profile X, is not particularly shy of different verticals within the IT business. Your income, like LP, does not depend on the success of a specific project, and the growth rate of the industry (in our case crypto economy) in General. Therefore, your figure is the index and the index crypto economy is obviously aware of Bitcoin. To crypto projects would be successful they are critically needed ecosystem: Gnosis to grow, people must have the demand for economically reliable truth; to grow Storj, people have to be the crypt in order to pay for it; to grow Steemit and Brave, advertisers should be motivation to buy traffic for the crypt, and the users motivation to earn income in the crypt, and so on — creating a financial and technical ecosystem, it is necessary to provide the full range of possible usage.

A naive conclusion from this is that your goal as an investor is growth in the industry, so a bet on the index and the easiest (and least risky) way to do this is to buy bitcoins. Just buy & hold strategy for the same logic will not provide you a return below or equal to the index, and long-term to show the best than the index strategy will only allow active management. Which is good, but it is much labor-intensive.

Nice post and graphs! How did you make those graphs?

Nice article. I was about to post a similair post. I've bene asking myself. Do people actually check the Trustworthiness of the crypto they invest in or do they just blindly see money money money? :-) I was wondering if anyone of you uses: https://www.coincheckup.com. I really missed a platform that analyses every single coin in depth but this site gave me all the answers.

Spamming comments is frowned upon by the community.

Continued comment spamming may result in action from the cheetah bot.

Nice