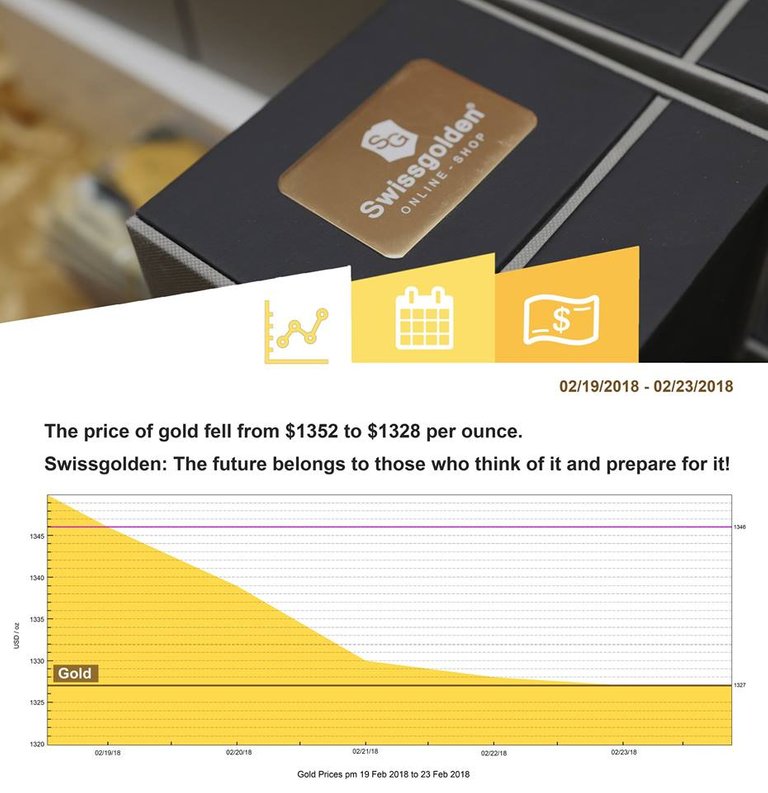

Review of the gold market from 19th to 23rd of February, 2018

Last week gold continued to trade on the sideways. Quotes of the precious metal were unable to escape from the corridor between 1315 and 1350 dollars per ounce.

On the one hand, the price of the yellow precious metal support fears of further collapse in the US stock market. Fund managers traditionally are insured against stock market panic when buying gold. On the other hand, precious metals pressured the plans of the U.S. FRS to raise interest rates in 2018 more aggressive than investors expected.

February 19:

The precious metals markets today, falling under the influence of a strengthening US dollar, also because of rising stock market and lower yields. A long weekend is continuing in Asia, which reduces the activity of trade.

Today the United States celebrate the President's day, which also reduced market activity.

The price of gold was $1346 per troy ounce.

February 20:

In the coming trading days, the participants of precious metals market will be closely watching the data on inflation in different countries. It should also be recalled that the decline in the stock market in the U.S. was primarily due to higher inflation than previously expected.

Gold prices fell to the level $1339 per troy ounce.

February 21:

Gold markets today are growing up under pressure of the strengthening U.S. dollar rate. Tonight there is expected the publishing of the protocol from the latest U.S. FRS meeting, which could increase the volatility influenced by the views of the regulator about inflation.

Gold prices fell to the level of $1330 per ounce.

February 22:

The precious metals markets remain under pressure from a strengthening US dollar, showing a gain in growth after the release of minutes from the latest U.S. FRS meeting.

Gold prices dropped to the level $1328.

�

February 23:

�Gold prices continue to fall to $1327 per troy ounce.�

At Swissgolden company you have the opportunity to make money regardless of changes in the price of gold!

- Be the best! - Have the best!