So, today we're diving into a topic that’s got a lot of people talking since Donald Trump’s election.

TARIFFS

Let’s start with one of Trump’s key promises: cutting taxes. Yep, exactly what you’re thinking. Trump wants to lower tax rates to keep more money in the pockets of American citizens and businesses. That’s awesome! you might think if you are a US citizen . Sure, who wouldn’t want to pay less in taxes? But here’s the catch—lower taxes mean less revenue for the government. And how will they fill that gap? With tariffs!

Trump has already pledged to impose a 25% tariff on all products from Mexico and Canada as leverage to combat illegal immigration and drug trafficking.

And, of course, China is also in the crosshairs. Additional tariffs of 10% are being considered for goods already taxed, due to China’s failure to curb the flow of fentanyl into the U.S. Let’s not forget that during the campaign, Trump even floated the idea of tariffs ranging from 60% to 100% on Chinese imports.

Wait, what do tariffs have to do with drugs? Absolutely nothing. But by slapping tariffs on these countries, Trump hopes to pressure them into taking action against these issues.

Now you’re probably wondering, Okay, but won’t tariffs hurt businesses and consumers? The truth is, tariffs often lead to higher prices for consumers since companies pass on the increased costs.

But we need to look at the bigger picture. The Trump administration aims to use tariffs as a negotiation tool, with two main objectives:

Bringing production back to the U.S. Since higher import costs will make American businesses more competitive.

Boosting government revenue. Every dollar collected from tariffs goes straight to the federal budget.

Despite some short-term issues, the long-term benefits could be significant. How? It’s simple

Domestic industries could recover.

The U.S. might gain leverage in international trade deals.

And finally, tariff revenue could offset some of the costs of tax reform.

So, while tariffs may not be a quick fix, they’re part of a broader strategy to shake things up economically and politically and have a bargaining chip.

But the bigger question is will they work? take a look at occasions that tariffs were implemented.

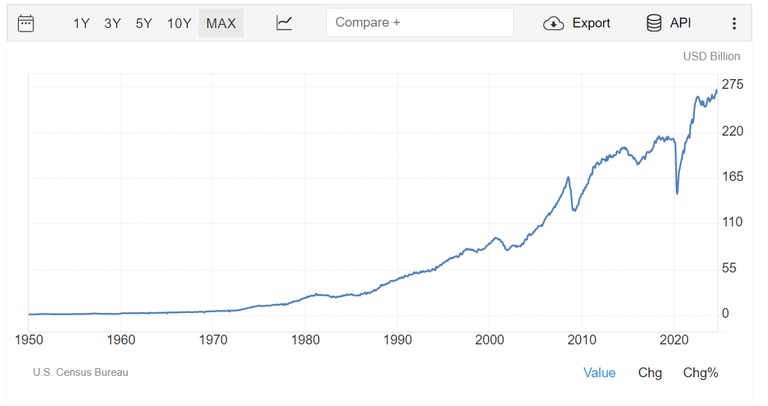

The Smoot-Hawley Tariff Act (1930s):

Designed to protect U.S. farmers during the Great Depression, it triggered global retaliation, worsened the depression, and shrank international trade.

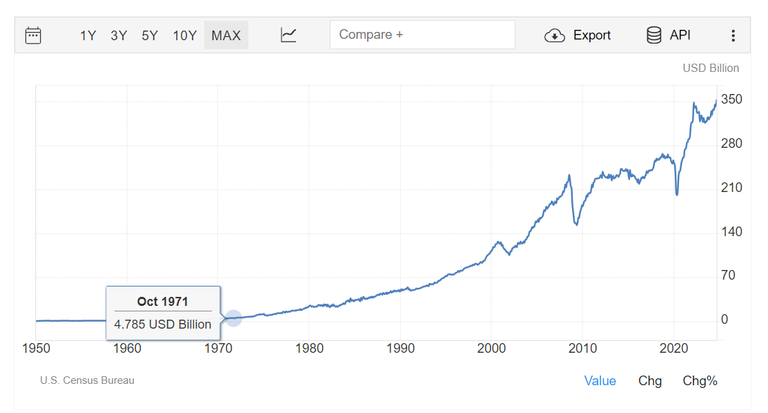

Trump Tariffs (2018–2020):

Targeted China and aimed to boost American manufacturing. While some industries benefited, others (like agriculture) suffered due to retaliatory tariffs. Consumers also faced higher costs for goods like washing machines and electronics.

Posted Using InLeo Alpha

I'm all for non-punitive tariffs as a replacement for the income tax if the income tax is truly abolished. However, that would require a constitutional amendment. I don't see it happening.

Tariffs designed to encourage unrelated behavior...I'm not sold on and it really amounts to a tax increase. It's just more hidden in the cost of items.

Simply trading lower income taxes for tariffs is likely to hurt lower income people more. I suppose you could say the same about replacing the income tax altogether with tariffs too, depending on what items had tariffs applied.

Something to consider would be to replace all corporate taxes with tariffs. Both increase the cost of goods but better to increase the cost of imported goods than domestic ones.

As always the lower income households will affect the most because they will have to buy the same things more expensive so they will either stop buying or have less money to spend elsewhere and that means less spending in general . I can understand when there are target tariffs in specific products or sectors that are vital but historically tariffs in general won’t work .

@tipu curate

Upvoted 👌 (Mana: 1/41) Liquid rewards.

Don't worry, my country (Brazil) is getting much worse than the United States. The taxes here are so unnecessary or invented by the government

Like all taxes 😂