Hi investors,

Today I am sharing my thoughts on Zcash and investing in privacy coins.

This article was inspired by the surprisingly underwhelming Zcash Thesis published by Placeholder Capital.

I am a strong believer in privacy which think is particularly needed in blockchain systems. However, I couldn't shake the feeling that Placeholder's paper didn't do justice to the Zcash project nor underlined the risks of investing in ZEC.

This is my attempt to frame the discussion around Zcash under a different light.

Let's dive in.

Zcash.

We'll start with a few words about the history of the network (I) before looking at the supply of Zcash coins (II). We'll then look at some issues with Zcash brand of privacy (III) and discuss potential bullish catalysts (IV). Finally, I'll share my own observations and how I would allocate Zcash into a crypto portfolio (V).

I. History.

The history of the network is brilliantly summarized in **Messari's Zcash deep profile** which I took the liberty to use here.

Created in 2014, Zcash, previously known as “Zerocoin”, was initially suggested as an experimental privacy extension to Bitcoin using advanced mathematical techniques called "zero-knowledge proofs".

Due to the Zerocoin protocol's novelty and computational intensity, however, Bitcoin core developers deemed it impractical for implementation into the Bitcoin protocol.

Subsequently, with additional improvements to the protocol that resulted in substantially more efficient zero knowledge proofs, Zerocoin's founding scientists from John Hopkins in collaboration with researchers from MIT and Tel Aviv University created a new protocol called "Zerocash" (Zcash).

Upon recruiting its CEO, Zooko Wilcox, to head the project and raising over $3mm in venture funding through two fundraises, the Zcash protocol began development under the Zcash Company, with the objective of building the Zcash protocol into a full-fledged cryptocurrency (ZEC).

In 2017, a separate entity, the Zcash Foundation was incorporated as a 501(c)3 nonprofit with the mission to build internet payment and privacy infrastructure for the public good, primarily serving the users of the Zcash protocol and blockchain.

In 2019, the Zcash Company rebranded to the Electric Coin Company (ECC).

II. Coin Supply.

Zcash's genesis block was mined on October 28, 2016.

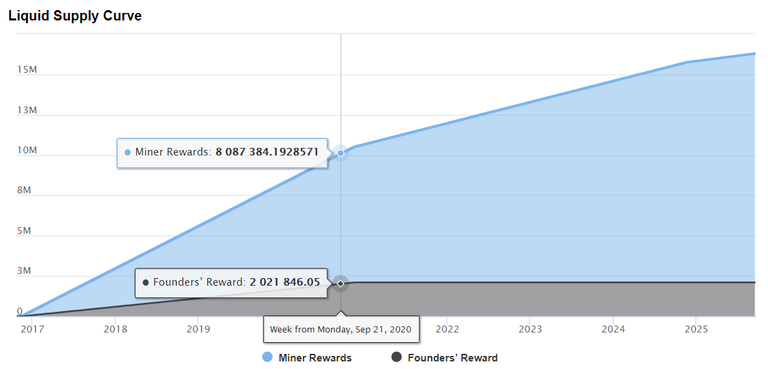

The network observed a fair (POW-mined) launch with built-in treasury. According to the protocol rules, roughly 5% of the supply of newly mined Zcash (ZEC) would go to the ECC to fund development and 15% to its founders and early investors (many of which were involved in the development of the project).

ZEC's total supply was also capped to 21M coins to increase its appeal to miners and bootstrap an early hashing power market.

Touted as a better, private version of Bitcoin, the hype leading up to the first listing of ZEC rapidly grew out of control.

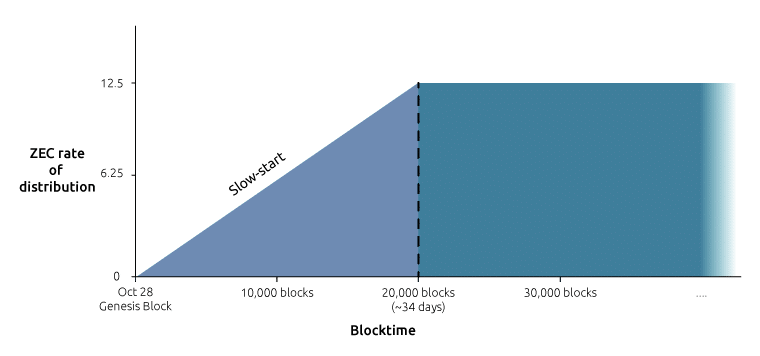

The buzz was also amplified by ECC choice for a "slow [mining] start" aiming at creating a fairer distribution for small miners by restricting the initial block reward.

The slow-start compressed the scarcity of ZEC even more and led to a very extreme L-shaped price-discovery.

Upon ZEC listing on Poloniex on October 29 2016, the price of 1 ZEC reached a mind boggling 3,300 BTC (valued at $36,161,400 USD at the time of writing) before crashing down and dead cat bouncing into a long bearish tail.

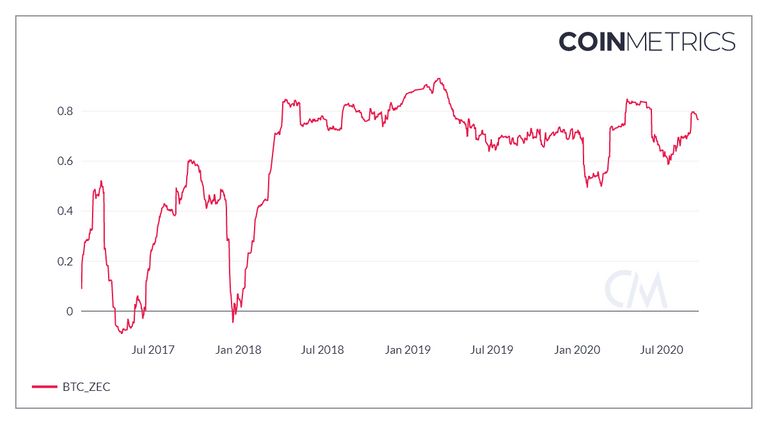

ZEC has been on a continuous decline against BTC ever since.

One of the reasons why ZEC quickly lost value against Bitcoin was its extreme inflation.

To this day, ZEC's stock to flow is almost 10 times smaller than BTC's.

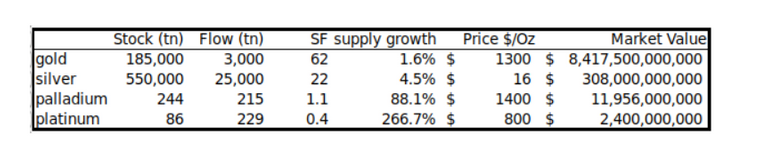

Stock to Flow (SF) is a measure of scarcity for commodity goods like precious metals or scarce cryptocurrency like Bitcoin. The formula is described by Saifedean Ammous in his book The Bitcoin Standard.

SF = stock / flow

where:

Stock is the size of the existing stockpiles/reserves/supply.

and

Flow is the yearly production.

For example, Bitcoin's current SF is 55.01. This means that at the current rate of production (6.25 BTC created every 10 minutes), it would take about 55 years to arrive at the current supply of coins (18.494 million).

Note that in POW coins observing a Nakamoto consensus, SF is a dynamic measure which increases over time as the block rewards halves every 4 years but the supply cap stays constant.

Below are SF measures for different commodities including ZEC, BTC and gold.

ZEC's very low SF is both a function of its higher block reward (since the project is much younger than BTC) and much faster block time (2.5 minutes).

A low SF confirms that the coins is still in a very inflationary phase. At the current rate of inflation (12.5 coins / 2.50 minutes) it would "only" take over 6 years to arrive at the current supply of ZEC.

This high inflation partly explains why the price of ZEC has on continuous bearish trend. The supply is simply to great to sustain a higher valuation at the current rate of inflation.

But inflation alone cannot explain ZEC's very disappointing market performance.

The demand for ZEC has also been extremely low compared to that of Bitcoin or even others privacy coins like Monero.

III. Zcash not-so private privacy.

Zcash's privacy model is based on zero knowledge proofs (also know as zk-snarks).

A zk-proof is a mathematical way to prove the existence of a fact (like a balance amount) without revealing any information about that fact (like the exact number in the balance).

The concept is brilliantly explained by Zooko himself in this video.

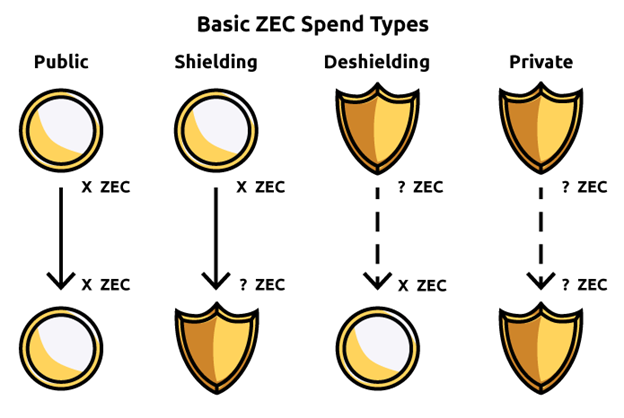

Concerned by the potential legal ramifications of making ZEC a private coin by default (like Monero), ECC made the decision to give users the choice to use so-called transparent addresses (t-addresses) alongside private (shielded) addresses.

This decision turned out to be very harmful to the project. Having t-addresses interact with shielded addresses makes it possible to track the provenance of de-shielding transaction (private to transparent) and identify the sender.

In a recent report by blockchain forensic company Chainalysis, it was reported that:

Roughly 14% of Zcash transactions involve one of Zcash’s two shielded pools in some way. But of the transactions that interact with a shielded pool, only 6% are completely shielded, i.e. sender, receiver, and transaction amount are all encrypted. That’s only 0.9% of all Zcash transactions.

So even though the obfuscation on Zcash is stronger due to the zk-SNARK encryption, Chainalysis can still provide the transaction value and at least one address for over 99% of ZEC activity.

The key takeaway here is that although the privacy guarantees of zk-proofs are extremely strong, the interaction between a small private pool of coins with a much larger public/transparent pool of ZEC is detrimental to the overall privacy of Zcash and no better that the privacy techniques that already exist on Bitcoin (like coin joins, mixers and Wasabi wallets).

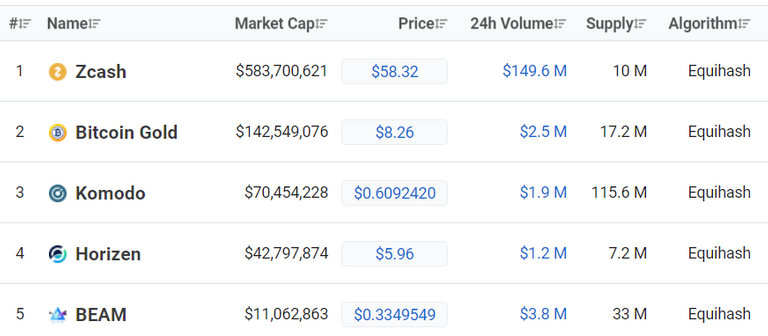

Without strong network privacy guarantees, ZEC coins have been treated by the market as yet another BTC fork, but one with a stellar development team and a strong network effect.

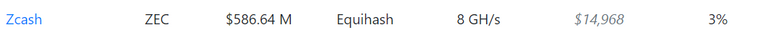

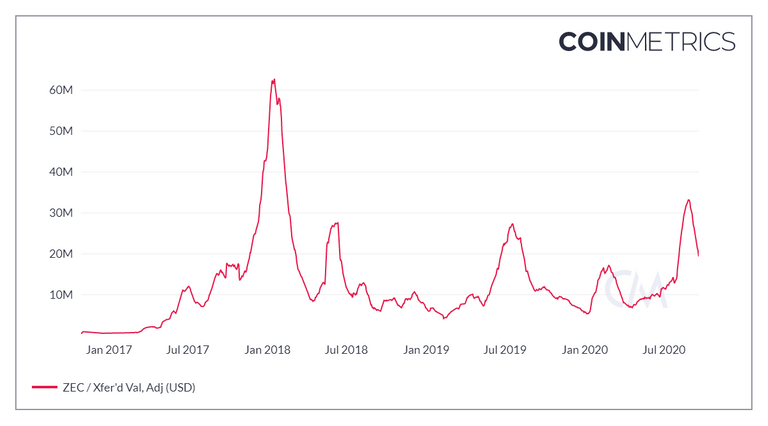

At the time of writing ZEC market dominance stands at 0.17% and settles around 21M in observable value every day.

Other bearish forces acting on ZEC include:

The fear of an inflation bug in the shielded (private) pool that could lead to unchecked supply inflation. Such bug was actually discovered but was remediated by the community. To this day there is no proof that the vulnerability was exploited by a malicious attacker but it underlines the risks of airtight zk-proof privacy and unverifiable total supply of coins.

The risk of delisting from exchanges in order to comply with anti-money laundering laws although the Zcash community has been hard at work to play nice with FATF regulators and prove it is not used on the dark web.

Although it seems like the project stands between a rock and a hard place, the project has achieved some significant breakthroughs that justify keeping an eye on the project.

IV. Bullish Catalysts.

As it stands, I see three potential catalysts that could give a boost to the price of ZEC.

1. Recursive Proofs.

The first catalyst is a major technological breakthrough called Halo.

Formalized in 2019 Halo is a practical zero-knowledge recursive proof composition without the need for a trusted setup.

A recursive zk-proof is:

A proof that verifies the correctness of another instance of itself, allowing any amount of computational effort and data to produce a short proof that can be checked quickly.

According to the ECC, such proofs

Hold the potential for compressing unlimited amounts of computation, creating auditable distributed systems, building highly scalable blockchains and protecting privacy for all of humanity.

The Zcash team is currently working on a second implementation of Halo:

ECC’s primary objective with Halo 2 is to make sure it’s ready to deploy in Zcash in 2021. We believe Halo 2 is the best way to eliminate the trusted setup from Zcash and to take a step on the path to Scalable Zcash at Layer 1.

Recursive-proofs open a tantalizing array of scalable applications for the zk-cash blockchain including:

- trustless blockchain privacy

- blockchain scalability at Layer 1

https://www.youtube.com/watch?reload=9&v=OhkHDw54C04

2. Zcash Halving & Revamped Funding Mechanism.

Zcash first ever halving will take place sometimes in November 2020.

Post-halving, the ZEC block-reward will be cut down to 6.25 coins which should alleviate a lot of the selling pressure on markets and considerably elevate EC's stock to flow to levels that make it a more appealing investment.

What's more, a substantial part of the founder reward will be re-routed towards funding ecosystem development efforts:

The first-halving in late November 2020, 7% of new ZEC issuance will fund the ECC’s efforts, including its development of zcashd (C++ based protocol implementation), user-friendly wallets, growth efforts and regulatory relations; 5% will fund Zcash Foundation’s (ZF) efforts, including their development of zebra (Rust based protocol implementation); and 8% of newly minted ZEC will be allocated by a community elected committee that funds grassroots efforts that aim to fill the gap between the ECC and ZF.

Zcash next upgrade Canopy will enshrine this new funding mechanism into code and will be deployed concurrently to the halving.

This is quite bullish for the Zcash ecosystem as new grants can help fund grass-root efforts such as app development, Halo 2 integration (which is now open-sourced) and literal bridge-building with other chains.

3. Healthy mining.

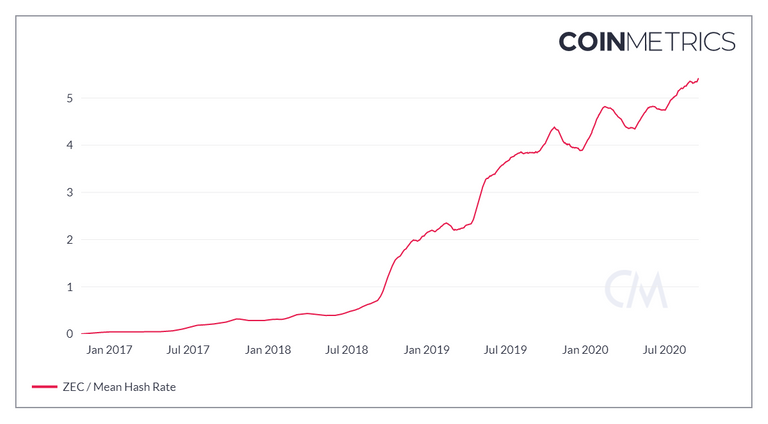

Perhaps the optimism surrounding the project is best indicated by a two-year continuous surge in hashing-power into the network.

ZEC is mined via solving for the Equihash algorithm and is the biggest coin by far in his hashing category both in terms of total market cap and total hashing power.

The mining data indicates a healthy network with constant growth in hashing power which provides good security against liquid-mining (Nicehash) attacks.

As we saw in our last piece about ETC and BTC security, miners commitment to front capital to acquire future coins is a fundamental piece of game theory for the security of the network as well as the best "skin-in-the-game" indicator for bullishness around the project.

V. Conclusions.

- For the longest time, Zcash felt to me like a glorified test-net for zk-proofs and ZEC a BUI for the ECC. That status-quo is starting to shift.

- The Zcash community decision to distribute the Founder reward more fairly between ECC, the Zcash Foundation and community-owed initiatives has shown that the project has matured and is decentralizing in a healthy way. This is no small feat for a project that has long remained very dependent to the ECC.

- Finally, the ECC decision to open-source Halo under a license that moats its intellectual property is smart and foreshadows some exciting development around scalable privacy that would exclusively benefit the network.

The following is not financial advice:

- I think that ZEC is probably undervalued at current prices because the market has been discounting its (previously) weak IP moat and future inflation too much.

- However, I still don't see ZEC as a very attractive addition to a crypto protfolio already heavily weighted towards BTC. The reason being that ZEC has too high of a positive correlation with BTC.

Bitcoin and Ethereum already provide some level of privacy. On Ethereum, projects like Aztec or Loopring aim at directly using zk-proofs to boost blockchain performance and provide privacy.

However, I think there is space for Zcash to realize some interesting (and potentially ground-breaking) applications like being a decentralized bridge between a number of chains or demonstrate high L1 scalability for a POW chain.

I'll be following the project with interest going forward and maybe adding a little ZEC to my portfolio for the sake of "having skin in the game".

See you next weekend for more market insights.

Until then,

🦊

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

<table><tr><td><img src="https://images.hive.blog/60x70/http://hivebuzz.me/@f0x-society/upvoted.png?202009201551" /><td>You received more than 1250 upvotes. Your next target is to reach 1500 upvotes. <p dir="auto"><sub><em>You can view your badges on <a href="https://hivebuzz.me/@f0x-society" target="_blank" rel="noreferrer noopener" title="This link will take you away from hive.blog" class="external_link">your board and compare yourself to others in the <a href="https://hivebuzz.me/ranking" target="_blank" rel="noreferrer noopener" title="This link will take you away from hive.blog" class="external_link">Ranking<br /> <sub><em>If you no longer want to receive notifications, reply to this comment with the word <code>STOP <p dir="auto"><strong><span>Do not miss the last post from <a href="/@hivebuzz">@hivebuzz: <table><tr><td><a href="/hive-192847/@hivebuzz/update-for-regular-authors"><img src="https://images.hive.blog/64x128/https://i.imgur.com/Bkdl8Vk.png" /><td><a href="/hive-192847/@hivebuzz/update-for-regular-authors">Update for regular authors@tipu curate

Upvoted 👌 (Mana: 1/16)

Very interesting and documented post about zCash which I did not know much about.

The upcoming changes of governance, incentives, upgraded halo, ... seem very nice and would make me want to invest if the market was not so focused on yield farming 👩🌾 and making a quick buck.

It is funny how investment in crypto is fueled by “trends”. Nowadays nobody cares about privacy coins when back then they used to be a sub-asset class in crypto.

I am glad you had the time to write such a good piece and teach me a lot of things about ZCash.

Why did you decide to look deeper into that one and not another one?

Cheers 🍻

Thanks for the kind words mate :)

Yeah, I was just sick of all the vegetable farming on DeFi haha, always been interested in privacy and Zcash is a great project, worth keeping an eye on what they're doing,

How's everything with you?