Hi investors,

Today we're talking about Modern Monetary Theory, why it's capturing a lot of mental real-estate in the highest spheres of US power. I'll also share my thoughts about MMT as a Bitcoiner and talk about Bitcoin as a corporate treasury asset. Finally, I'll give you my take on whom I believe will win the US election.

Let's dive in!

Modern Monetary Theory.

Modern Monetary Theory (MMT) is an economic theory of money which states that government spending should only come from new money creation by the government itself.

Key to this theory is the idea that a sovereign government (like the federal US government) does not need to earn money (via taxation) before it can spend (via fiscal deficit).

In that sense, MMT is counterintuitive and exposes the fallacy of political discourse comparing governments to normal households.

Governments simply do not budget like households do

A typical household (say a nuclear family of 3) need to earn money (via a salary) before it can spend to acquire goods and services (for example to buy a new dishwasher).

Governments on the other hand do not need to earn before they can spend.

This is because governments have an absolute monopoly on money creation via their Central Banks. As a result a government can always create new money and use it to stimulate the economy.

What about taxation then? Why would the government need to raise taxes if it can simply conjure money into existence?

According to MMT, taxation is actually a very important mechanism:

- because it regulates the amount of money into the economy in order to avoid hyper-inflation (too much money chasing to few goods);

- because it makes fiat money the only legal tender which can be used to pay taxes and so forces its use into the economy.

The main takeaway here is that, according to MMT, governments can never go "broke" since they have discretionary power to create new fiat.

In the vein of Keynesian economics, MMT actually exhorts governments to make use of the printing press to stimulate their economy as long as new money creation doesn't produce an un-desired amount of price inflation.

As a theory, MMT is considered to be the brainchild of Warren Mosler but today the theory's is pushed in the highest circles of US power by the very influential Stephanie Kelton who is the author of The Deficit Myth.

In a nutshell, Kelton is trying to "green-pill" the US federal government into dropping the "we're broke" narrative and make use of un-ashamed money creation to create fiscal stimulus.

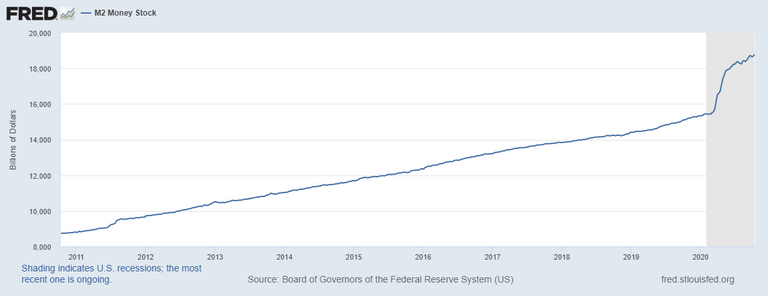

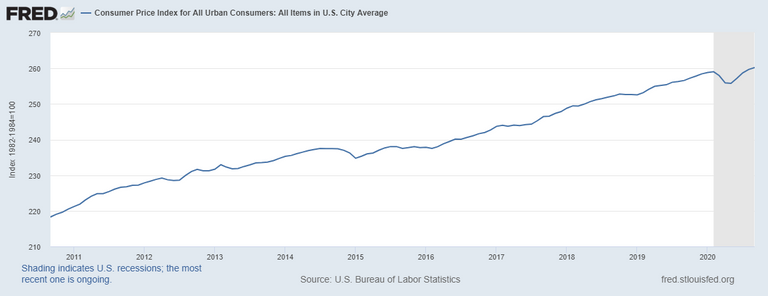

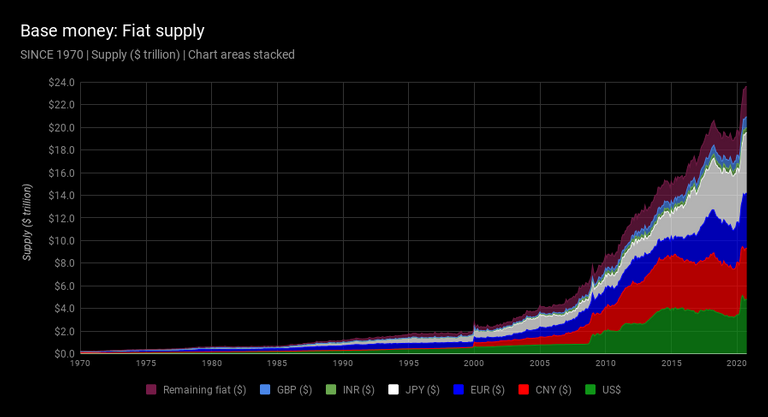

MMT is very much this idea "whose time has come" as it's becoming increasingly clear that the doubling of the US monetary base in the last 10 years has not doubled the amount of inflation, let alone created out-of-control hyper-inflation in the US.

How could that be?

Well, it's mainly because most of the money that is created by the US Government (via the FED) has been used to re-capitalize banks. However banks haven't use that money to collateralize new loans. New money has not penetrated into the economy and so it hasn't created significant levels of inflation.

But there's a catch.

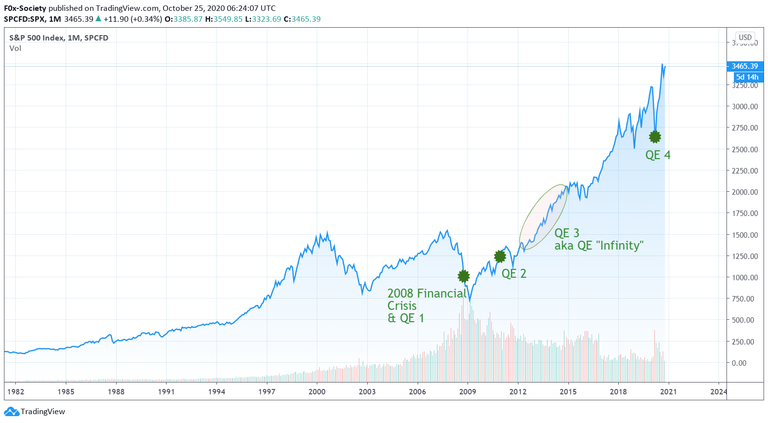

New money has been invested into growth assets like equities. This has created a massive price inflation and a global momentum for storing value into the S&P500 since cash can be so easily debased by government fiat.

The great injustice of MMT is that it's deepened the wealth gap between asset holders and cash holders. This has been the result of an information asymmetry between the financially literate (those who know that cash is trash) and financially illiterate (those storing their monthly paycheck on a saving account at a bank) that has compounded over the last 10 years.

Furthermore, this asymmetry cuts right between two demographics. On the one hands the lucky few who've had access to a business/finance college education or mentorship through their family or a successful person in their orbit.

On the other hand those who never had a chance to be told what was really going on i.e. cash is being constantly debased and is on its way to lose 90 of its purchasing power.

So, this is where we are today. Inflation has been stagnating well below the target rate of 2% for a decade despite a doubling of the monetary supply. Meanwhile the amount of debt in the system has exploded. The game now is to "inflate the debt away" by overshooting inflation.

And what better way to create inflation that to create new money in a stagnant economy?

The message is clear: continue spending like there is no tomorrow.

Source: https://cryptovoices.com/basemoney

Rising to the occasion is MMT which, through Kelton's book, is delivered as a recipe for economic revival and a vindication of a decade of irresponsible spending by the government.

As a Bitcoiner, it's clear to me that MMT has a dark underbelly although I am convinced that Kelton is completely well-intentioned in her crusade to push the idea.

Let's go through the list of MMT's negative consequences.

What's Wrong About MMT.

First we don't have good tools to calculate price inflation. The CPI is frankly a flawed metric as price inflation is asymmetric across goods and services (it doesn't affect them all equally and at the same rate). Since we have no good way to measure inflation it is dubious to me that we can control inflation to start with.

Second, taxation is typically a lagging and imperfect mechanism (tax evasion) so relying on it to "skim the top" and take excess liquidity out of the system doesn't sound reasonable to me.

Third, enormous money creation has this Cantillon effect that eventually rewards those closest to the money spigot. As we've already mentioned, money creation debases the value of cash to the benefit of those holding assets (equity, real-estate, etc.). Meanwhile, the naïve Joe who patiently saves a fraction of his monthly paycheck into his saving account experiences a slow but inexorable erosion of his purchasing power. Again, this has had the consequence of widening the gap between the financially literates (who store value in assets) and financially illiterates (who store value in cash).

Fourth, MMT weakens the moral obligation for paying taxes in the eyes of the plebe. Since money creation is at the core of any spending, to the uninitiated it might appear as if taxes are unfair ("They can just print MORE money!") where they are actually very important for the system to work correctly. Don't expect Joe six-pack to understand the subtleties of MMT, for most folks MMT just looks like blatant "money printer go brrrr".

As a consequence, I believe that MMT has been one of the reasons for the recent surge in nihilism across the US. The widening of the wealth gap between asset holders and cash savers is happening against a backdrop of unfettered money creation and booming S&P500. This to me screams political instability.

Furious anger will come with the broad realization that nobody never told you that cash was a bad store of value. You've been patiently hoarding cash on a bank account for years for 0.5% interest while the price of housing was doubling every five years? Too bad, you should have know better.

Finally, I think that MMT is only sustainable if the money you're printing is the world reserve currency. Listening to Kelton say that countries cannot go broke since they can always turn on the printing press doesn't compute well with the situation of impoverished countries whose fiat money is not accepted to settle international trade. The US' exorbitant privilege is that they print a currency that is used and needed globally to oil global commerce. This, I believe, has a dampening effect on inflation because a lot of the USD leaks out of the economy all the time.

So where do we go from there?

Forecast & US Elections.

Well I don't really expect the situation to change. I think that both political parties are okay with using monetary inflation to stimulate the economy. I think that the stimulus package currently submitted to Congress is being slowed down for political reasons linked to the election. I don't think the Democrats want the Trump administration to get all the credit for passing a (much expected) stimulus and will block it until after the election.

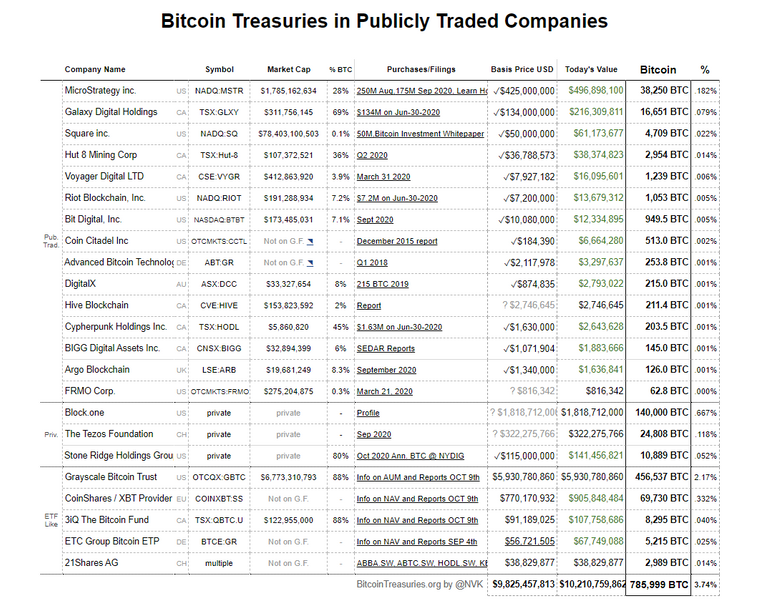

In such environment, Bitcoin will continue gaining in popularity with retail and corporate alike. Retail on the one hand will continue being "orange-pilled" into discovering what bad a store of value cash really is. Corporate will continue allocating more and more of their treasuries into BTC to get yield. While the former is already well established,we're seeing the momentum for BTC as a corporate treasury asset thanks to publicly listed companies like MicroStrategy or Square putting BTC on their balance sheets.

Source: https://bitcointreasuries.org/

I also think that MMT is now completely entrenched in the highest circles of power and will be the justification for the existence of Central Banks Digital Currency because it will give the power to the government to directly create fiscal stimulus in the economy without being intermediated by banks. In other words, the government will directly credit your account at the click of button. This by the way paves the way for some fascinating development like algorithmic fiscal stimulus where the amount you receive is constantly recalculated depending on your situation, earnings etc.

One think is certain, financial privacy is dead as far as the fiat system is concerned and this has some scary implication which I may talk about in a subsequent blog.

Finally, I think that Trump will get re-elected, all this talk of Biden ahead in the polls reminds me of 2016, plus something like 2/3 of presidents that ran for a second term got re-elected so probabilistically it makes sense to predict a Trump win.

But I guess we shall see.

See you next weekend for more market insights.

Until then,

🦊

@tipu curate

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

<table><tr><td><img src="https://images.hive.blog/60x70/http://hivebuzz.me/@f0x-society/upvoted.png?202010241601" /><td>You received more than 1750 upvotes. Your next target is to reach 2000 upvotes. <p dir="auto"><sub><em>You can view your badges on <a href="https://hivebuzz.me/@f0x-society" target="_blank" rel="noreferrer noopener" title="This link will take you away from hive.blog" class="external_link">your board and compare yourself to others in the <a href="https://hivebuzz.me/ranking" target="_blank" rel="noreferrer noopener" title="This link will take you away from hive.blog" class="external_link">Ranking<br /> <sub><em>If you no longer want to receive notifications, reply to this comment with the word <code>STOP <p dir="auto"><strong><span>Do not miss the last post from <a href="/@hivebuzz">@hivebuzz: <table><tr><td><a href="/hivebuzz/@hivebuzz/papilloncharity"><img src="https://images.hive.blog/64x128/https://i.imgur.com/AL9FW96.png" /><td><a href="/hivebuzz/@hivebuzz/papilloncharity">Hivebuzz support the Papillon Foundation Charity project<tr><td><a href="/hive-120078/@hivebuzz/october-2020-is-the-world-mental-heath-month"><img src="https://images.hive.blog/64x128/https://i.imgur.com/GWiQc2h.png" /><td><a href="/hive-120078/@hivebuzz/october-2020-is-the-world-mental-heath-month">October 2020 is the World Mental Heath Month