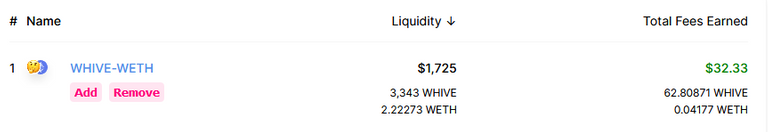

Sure - you get share of the trading fees on uniswap (and other defi swap platforms) for providing liquidity. Will write about in soon :) Here's my earnings since yesterday for WHIVE : ETH pair. Please note it might be skewed a little as yesterday WHIVE was overpriced on uniswap.

Also it didn't change much today but that's because of ETH fees that are too high compared to the max trades you can do. In other words - we need more liquidity.

I hope you are aware of impermanent loss, if hive rises than the time you provided liquidity you will have less hive.

Edit: to minimize this balancer would be a better choice since you can create custom pools there instead of 50/50 of uniswap. On balancer you can have 90/10 (hive/dai), you will still have impermanent loss but it will be less and it will be negligible after bal token and other fee earnings.

Posted using Dapplr

Yes, although the theory is that in the long-term the earned fees will be higher then the loss in this case. Of course you can always withdraw your provided liquidity if HIVE price will start to go up and use it to buy move HIVE :)

Man, I need to look into this a bit more but I’m pretty much ready to provide liquidity once I read up on everything to understand the economic and security risks.