The Federal Reserve Bank of San Francisco published a study suggesting a strong correlation between the introduction of Bitcoin (BTC) futures and the depreciation of BTC’s price at the end of last year.

Personally I feel this way as well, knowing what I know about numbers and stats and trends as well as the Mt. Gox trustee dumping BTC at intervals also showing it has affected the supply and demand to some extent.

These 2 co factors do have something to do with the markets. That is my opinion.

As much as I detest globalist owned and controlled lamestream media and government, paid off and lying to the masses, I will use them to promote what I believe in, as in this case.

The masses read and absorb mainstream media. Fact.

Government adoption of blockchain is important for mass adoption.

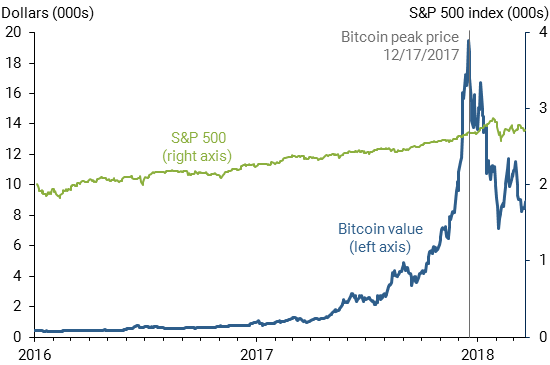

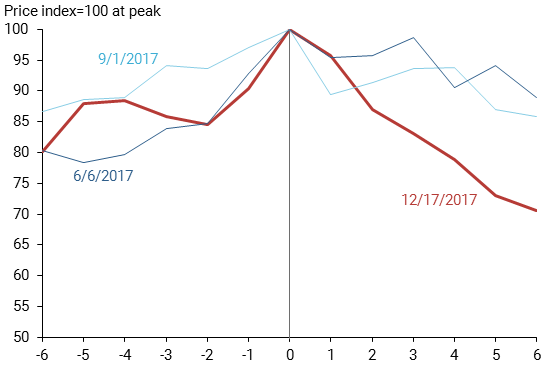

The peak price coincided with the introduction of bitcoin futures trading on the Chicago Mercantile Exchange. The rapid run-up and subsequent fall in the price after the introduction of futures does not appear to be a coincidence. Rather, it is consistent with trading behavior that typically accompanies the introduction of futures markets for an asset.

Bitcoin is a “cryptocurrency”—a digital currency that is not backed by any tangible or intangible assets of intrinsic value. After its launch in January 2009, the dollar price of a bitcoin remained under $1,150 until February 22, 2017, when it increased exponentially for about 10 months, as shown in Figure 1. This explosive growth ended on December 17, 2017, when bitcoin reached its peak price of $19,511. Notably these dynamics aren’t driven by overall market fluctuations, as shown by comparison with the Standard & Poor’s 500 stock index.

This one-sided speculative demand came to an end when the futures for bitcoin started trading on the CME on December 17. Although the Chicago Board Options Exchange (CBOE) had opened a futures market a week earlier on December 10, trading was thin until the CME joined the market. Indeed, the average daily trading volume the month after the CME issued futures was approximately six times larger than when only the CBOE offered these derivatives.

The links are here:

Thanks for Reading!