The following articles, videos and additional info show the sea change happening now as big banks hop on the bitcoin bandwagon!

By Neenah Payne

The Forbes October 26 article Why America’s Biggest Bank Is Suddenly Very Bullish On Bitcoin says:

JP Morgan, the largest U.S. bank by assets, has this year softened its previously harsh tone on bitcoin. The bitcoin market has matured since JP Morgan chief executive Jamie Dimon called bitcoin a "fraud" in September 2017—helped by the (still highly volatile) bitcoin price finding support as an inflation hedge alongside gold this year.

Now, JP Morgan has said bitcoin's strong 2020 could be set to continue, finding the bitcoin price has "considerable" upside in the long-term as it better competes with gold as an "alternative currency." "Even a modest crowding out of gold as an 'alternative' currency over the longer term would imply doubling or tripling of the bitcoin price," JP Morgan analysts on the bank's Global Quantitative and Derivatives Strategy team wrote in a note late last week, adding the "potential long-term upside for bitcoin is considerable" and pointing to Millennials becoming "a more important component of investors' universe" as a potential catalyst.

Bitcoin's reputation as "digital gold," especially among Millennials and younger investors, has swelled this year, boosted by a number of high-profile investors adding bitcoin to their portfolios and talking up bitcoin's prospects. For bitcoin to catch up to gold's $2.6 trillion market value, the bitcoin price would have to increase 10-fold from its current $13,000 per bitcoin, the bank's analysts noted.

Meanwhile, bitcoin was thrust into the headlines last week when payments giant PayPal PYPL +0.9%, a long-perceived enemy of bitcoin and cryptocurrencies, announced it would begin allowing its 346 million users to buy and spend bitcoin and a handful of other major cryptocurrencies. "Cryptocurrencies derive value not only because they serve as stores of wealth but also due to their utility as means of payment," JP Morgan analysts added. "The more economic agents accept cryptocurrencies as a means of payment in the future, the higher their utility and value."

Buying Bitcoin Now Like Buying Google and Apple Early

Bitcoin has come a long way in the ten years since it was created but, for some, it still feels early. The bitcoin price, climbing to year-to-date highs this week and recapturing some of the late 2017 bullishness that pushed it to around $20,000 per bitcoin, has found fresh support from Wall Street and traditional investors this year.

Now, Wall Street legend and billionaire Paul Tudor Jones, who made headlines when he revealed he was buying bitcoin to hedge against inflation earlier this year, has said buying bitcoin is "like investing with Steve Jobs and Apple AAPL +0.7% or investing in Google early." "Bitcoin has a lot of characteristics of being an early investor in a tech company," Jones, who's known for his macro trades and particularly his bets on interest rates and currencies, told CNBC's Squawk Box in an interview this week, adding he likes bitcoin "even more" than he did when his initial bitcoin investment was announced in May this year.

Big Banks Turning Bullish on Bitcoin Should Have You Worried warns:

What an October it was for Bitcoin. The number one cryptocurrency by market cap has seen a 30% rise in its price over the last four weeks, making a 17-month high in the process. Even more impressive is how Bitcoin managed to shrug deteriorating macro-factors to achieve this. This is mostly thanks to a glut of positive sentiment coming from corporate America, who it seems, is starting to warm to the idea of a decentralized store of value network.

MicroStrategy was the first to stamp their approval on Bitcoin. What followed was a series of u-turns from industry-leading firms, some of which, in the past, have been openly vocal about their hatred of Bitcoin. The most prominent example being JP Morgan, whose CEO, Jamie Dimon, blasted Bitcoin as a fraud. Even going as far as saying Bitcoiners are stupid.

The article adds:

Banking’s Making U-Turn on Cryptocurrency. The general feeling is that banks getting on board with Bitcoin is a good thing. But, should we as libertarians and seekers of financial democracy be worried? As Kern alluded to, the banks have had it their way for so long. And so it’s difficult to imagine they also want financial democracy. The most likely motive behind the u-turn is not because they see the benefits of transacting peer to peer. Rather, they see the failure to get on board will leave them completely irrelevant. Banks have manipulated and corrupted every market they’ve been involved with. Just ask any precious metal investor. As such, banks turning bullish on Bitcoin needs seeing for what it is, a ploy to maintain financial authority.

Bitcoin: Digital Gold

America’s biggest bank, JP Morgan Chase, recently released a rare statement on the world’s flagship crypto, where it said that Bitcoin has what it takes to challenge gold’s status as the go-to alternative financial asset. When compared to other financial assets like gold and crude oil, Bitcoin looks relatively small, considering that it has a market capitalization of $242 billion, compared to the precious metal’s (Gold) $2.6 trillion market value.

However, this means the crypto has more room for upside and can potentially compete with gold as the preferred alternative currency. In a report credited to Business Insider, America’s most valuable bank, JPMorgan Chase, gave valuable insights on why it believes the odds are with Bitcoin to keep rising in value. “Even a modest crowding out of gold as an ‘alternative’ currency over the longer term would imply doubling or tripling of the bitcoin price,” JPMorgan Chase said.

And over time, Bitcoin could be held for other reasons such as for making payments, not just for being a store of wealth as gold is, according to JPMorgan Chase. “Cryptocurrencies derive value not only because they serve as stores of wealth but also due to their utility as a means of payment. The more economic agents accept cryptocurrencies as a means of payment in the future, the higher their utility and value,” JPMorgan Chase explained.

Bank Analyst Puts Bitcoin Price Prediction "As High As $318,000"

A senior Citi executive predicts Bitcoin may reach the six-figure price mark in 2021. Bitcoin's rise has been similar to gold in the 1970s, the executive said. The rise of state-backed digital currencies also shows a changing regime, one that supports the growth of Bitcoin, he added.

Tom Fitzpatrick, a managing director at Citi, has predicted Bitcoin’s price may reach over $318,000 in 2021 as per a note to institutional clients last week. He called the move amidst an uncertain macro environment and its similarities to the gold market of the 1970s. While long called “digital gold” by crypto fanatics, Bitcoin has so far been a poor store of value (due to its infamous price swings) or medium of transfer and has emerged as a trading vehicle instead. However, as per Fitzpatrick, such a backdrop is exactly what primes the asset as one that would sustain an eventual “long-term trend.”

Fitzpatrick called Bitcoin the “new gold” and said the shaky macroeconomic climate of today is creating space for a new financial structure—similar to the backdrop of Bitcoin’s creation back in 2008, one of the biggest recessions in history.... The Bitcoin bulls are known to be optimistic. And for once, the banks are too.

Major Investment Bank Oppenheimer Bullish on Bitcoin, Highlights Instead of Gold reports:

U.S. investment bank Oppenheimer’s analyst says gold is “extended” and has “run up a bit,” bringing attention to bitcoin instead. He sees the cryptocurrency reversing its downtrend from the $20K peak, benefiting from the dollar’s weakness.

Ari Wald, head of technical analysis at Oppenheimer, a major American investment bank and financial services company, “highlighted” bitcoin this week on CNBC’s program Trading Nation entitled “Gold vs. Bitcoin.” He explained: “We’ve been recommending gold as a way to play the expansion of the Fed’s balance sheet … It’s actually the high momentum commodity. It ranks highest above all commodities out there in terms of momentum.” While pointing out that gold is “extended” and has “run up a bit,” the analyst affirmed, “We do recommend sticking with it.” Nonetheless, he added: “I think it’s worthwhile to highlight bitcoin instead which isn’t as extended … Bitcoin is reversing its downtrend dating back to its 2017 peak. If you are a long-term holder, this is the type of action you’d like to see.

The article adds:

Wald noted that the cryptocurrency’s recent breakout is setting up for more gains ahead and bitcoin’s long-term trendline suggests it has plenty of room to run. Meanwhile, the price of gold has hit record highs this week, rallying 8% this month and 28% this year.

Both gold and bitcoin are benefiting from the weakness of the U.S. dollar, Wald continued. Michael Binger, president of Gradient Investments, concurred with Wald about the dollar but he favors gold over bitcoin. Binger opined: “Between the two, I would really lean on the gold side here. When you think about it, it is really a Goldilocks environment for gold investors right now. I mean, you have a weak U.S. dollar, you have negative real interest rates. All of this is based on the prospect of rising inflation.” While agreeing with the Oppenheimer analyst that bitcoin is a momentum play, Binger still believes that it is not a “valid currency yet."

Report: Bitcoin: 21st Century Gold

Bank Analyst Puts Bitcoin Price Prediction "As High As $318,000" reports:

Citibank Group’s Global head of Citifxtechnicals product, Tom Fitzpatrick expects to see the price of bitcoin peaking at $318,000 by end of 2021. Although he concedes that his prediction might seem improbable, Fitzpatrick argues that such a surge will still be the weakest rally for the digital asset when compared to other assets such as gold. He also adds that bitcoin is all about the ”unthinkable rallies followed by painful corrections.” Bitcoin will see huge price swings before finally settling at the predicted price suggests Fitzpatrick.

Writing in a report titled, Bitcoin: 21st Century Gold, Fitzpatrick makes the surge argument for bitcoin. He says the digital gold’s current trajectory appears to be similar to that of gold in the 1970s. Before structural changes were implemented in the early 1970s, gold had spent 50 years of trading in the $20-$35 range. However, after changes were instituted gold surged. It recently touched a new all-time high in August before settling at just under $1,900 per ounce.

According to one report that analyzed Fitzpatrick’s paper, it is this “structural change in the modern-day monetary regime that ushered in a world of fiscal indiscipline, deficits, and inflation.” Therefore, the Citibank boss argues that bitcoin, which came to the fore at the aftermath of the “Great Financial crisis” of 2008-2009, is bound to have a similar run. With the Covid-19 pandemic still haemorrhaging economies around the world, governments will continue responding to the crisis by printing more money. This in turn will benefit safe-haven assets which perform well in inflationary periods.”

The video Citibank Report: Bitcoin Moon Target Set to Peak at $318K in December 2021! reports:

“Incoming Senator Hopes To ‘Bring Bitcoin Into The National Conversation’: “In a clip that has been widely circulating on Twitter, the soon-to-be-senator representing Wyoming — possibly the highest ranking US official to ever speak so glowingly of the digital currency — cited her experience as a former state treasurer for why she believes in Bitcoin’s future.

“I’m a former state treasurer and I invested our state’s permanent funds, so I was always looking for a good store of value, and Bitcoin fits that bill. Our own currency inflates; Bitcoin does not. Its 21 million Bitcoin will be mined, and that’s it, it is a finite supply. So I have confidence that this will be an important player in store of value for a long time to come.”

Paradigm Shift To Bitcoin: Gold 2.0

The video BITCOIN To $318K By December 2021 & The Digital Gold Of The 21st Century Says CitiBank! says the Citibank prediction of a bitcoin of $318,000 by December 2021 presents a paradigm shift! It points out: “An independent report titled “Bitcoin: 21st Century Gold” from Citi Bank’s Managing Director Tom Fitzpatrick argues that Bitcoin is the digital gold of the 21st century and that it will hit $318,000 by December 2021. The devaluation of the worlds’ reserve currency — the U.S. dollar —formed the basis of the commentary.”

The video explains that the COVID stimulus has fast-tracked the devaluation of the US dollar because more money was printed this year in America than in all previous years put together! It describes bitcoin as “Gold 2.0” because it is much more advanced.

Bitcoin Better Than Gold?

The article adds:

Still, Fitzpatrick explains that although gold is expected to benefit from the deluge of new money entering circulation, the precious metal has unique limitations that do not seem to afflict bitcoin. In his write up, Fitzpatrick notes: Gold has restrictions such as storage, non-portable, and could possibly be even called ‘yesterday’s news’ in terms of a financial hedge. Bitcoin is the new gold.

To support this view, the Citibank boss cites some of bitcoin’s key attributes which include the digital currency’s “limited supply, ease of movement across borders, and opaque ownership.” Consequently, Fitzpatrick believes more investors will choose bitcoin over gold as a result.

Meanwhile, Fitzpatrick predicts that bitcoin will be subjected to more regulatory constraints going forward. However, unlike other digital currencies such as central bank digital currencies (CBDCs), bitcoin cannot be confiscated, therefore making it a more secure asset.

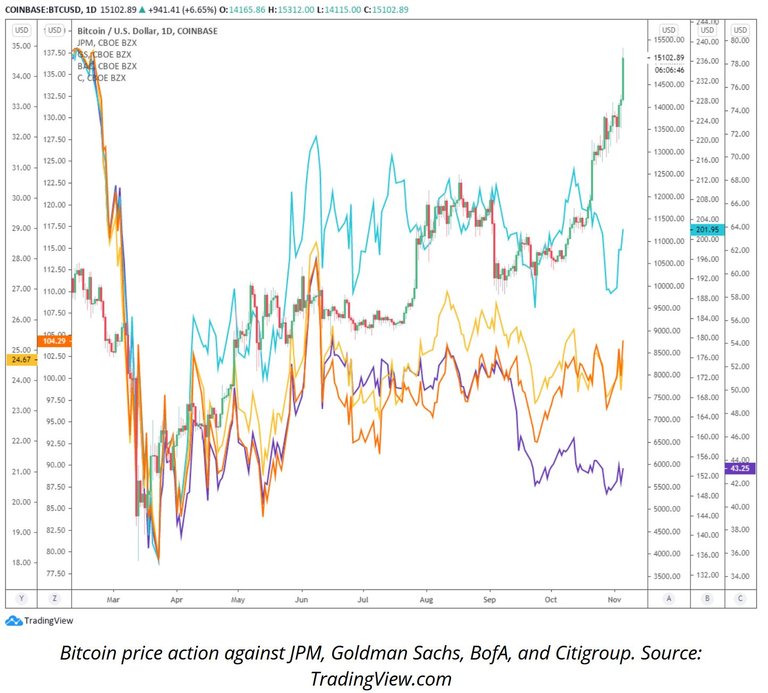

Bitcoin Outperformed Top Bank Stocks in 2020

Not bad for 2020: Up 42% in Q4, Bitcoin price outperforms top bank stocks: 2020 has been a rough year for markets but Bitcoin has outperformed JPMorgan, Goldman Sachs, and the majority of top U.S. financial sector stocks point out:

Historically, traditional market analysts and old school investors tend to look at Bitcoin and other cryptocurrencies with a wary eye, and when crypto pundits attempt to make comparisons between the two, these investors say it's an apples to oranges argument.

Take, for example, Warren Buffett, who many a time has said Bitcoin is nothing more than a Ponzi scheme as it does not produce anything and therefore has no value. According to these traditionalists, comparing Bitcoin to Apple, Tesla, or a bank stock like JPMorgan is irrational as the latter employ workers, produce products, and generate revenues and dividends which are distributed to shareholders.

Despite these arguments, a simple fact remains. Bitcoin has had a strong year and the digital asset is outperforming financial stocks in 2020 due to a considerable increase in institutional demand, investors' belief in BTC's exponential growth potential, and its asymmetrical price action in the face of global economic uncertainty.

As shown in the chart below, the majority of top U.S. banks posted record results in Q2 as the entire market roared back from the COVID-19-induced sell-off in mid-March, but significant threats to the stock market and global economy remain. At the same time, Bitcoin massively outperformed the financial sector, particularly in the fourth quarter.

The article continues:

Bitcoin has consistently seen a unique combination of surging institutional demand a steady increase in mainstream awareness. According to a survey released by Grayscale, more than half of U.S. investors are interested in investing in Bitcoin. The study said: “Interest is on the rise: More than half of U.S. investors are interested in investing in Bitcoin In 2020, more than half (55%) of survey respondents expressed interest in Bitcoin investment products. This marks a significant increase from the 36% of investors who said they were interested in 2019.

Businesses, investment banks, and retail investors have all recognized that there is great growth potential in Bitcoin, and this is possibly why companies like PayPal and Square, have decided to support cryptocurrency. Coincidentally, financial institutions that have actively supported cryptocurrencies have performed especially well in recent months. PayPal stock, as an example, rose 12% in the past three days, demonstrating optimistic momentum since it that it would integrate crypto buying and selling.

As 2020 comes to a close, investors of all levels will be keeping a close eye on Bitcoin's price to see if it continues to heavily outperform equities markets. The fact that major bank stocks like JPMorgan, Goldman Sachs, Citigroup, and Bank of America are falling behind a 'small-cap' cryptocurrency is a significant occurrence and this is likely to draw more curious investors to the crypto sector.

More Billionaires Buy Bitcoin Now

More Billionaires Buying Bitcoin says the Fund Manager Bill Miller explains that all the top banks will adopt bitcoin. Miller recommends that everyone get bitcoin now. The video reports that billionaire hedge fund manager Stanley Druckenmiller said in a CNBC interview that he believes bitcoin will replace gold as a store of value more quickly than many people realize. The video explains that a lot of the Big Tech money in Silicon Valley is going into bitcoin. In addition, Millennials and GenZ prefer it to gold.

The video says that Raoul Pal, CEO and Co-Founder of Real Vision, said the importance of Druckenmiller, the world’s greatest and most respected money manager, being long on bitcoin cannot be overstated because it removes every obstacle for any hedge fund or endowment to invest in bitcoin.

In Bitcoin Infiltrates Corporate America, Michael Saylor, Chairman and CEO of Microstrategy, Inc., was interviewed by Raoul Pal to discuss his decision to invest $425 billion of his firm’s money in bitcoin this summer. Saylor describes his first encounter with cryptocurrencies and how his views have evolved over the years. Saylor explains the power and value of bitcoin and its unique ability to convey “100 million dollars across 100 years.”

Why Michael Saylor Invested 700M Dollars In Bitcoin explains that after Saylor invested $425 million of his firm’s money in bitcoin, he invested $700 million of his own money in bitcoin. It is a very delightful and informative interview.

Big Tech Execs Adopt Bitcoin

Big Tech Execs and Bitcoin: Skype Cofounder Keeps Personal Wealth in Crypto, Intercom Chairman ‘Firmly Jumps on the Bitcoin Wagon’ points out:

This week two well known tech executives revealed they have been dabbling in bitcoin and other cryptocurrencies. In a recent interview, Skype cofounder Jaan Tallinn detailed that he held bitcoin and ethereum in his personal finances, while the Intercom cofounder Eoghan McCabe tweeted on Sunday that he’s “jumped firmly onto the bitcoin wagon.”

The article reports:

In 2020 a number of popular tech executives and CEOs from giant firms have revealed they hold a fascination for cryptocurrencies like bitcoin and ethereum. On Friday, the cofounder of the telecommunications application Skype discussed a couple of donations he made in the past leveraging ethereum and bitcoin. Skype’s cofounder Jaan Tallinn sent 350 ETH ($158k) to the London-based organization Faculty AI and in March 2020, Tallinn donated 50 BTC ($850k) to the group.

Following the interview with Tallinn, another well known executive told his Twitter followers on Sunday that he’s jumped into the bitcoin space. On November 15, 2020, the chairman and cofounder of Intercom, a well known American software firm, tweeted about the decentralized crypto asset bitcoin. Intercom’s Eoghan McCabe disclosed he is holding bitcoin after messing around with the digital currency for years.

“I would like to announce that after years of dabbling, I’ve jumped firmly onto the Bitcoin wagon,” McCabe tweeted. In a tweet that followed, McCabe noted that he’s been listening to the Pomp Podcast and one in particular that features the Bitcoin evangelist Robert Breedlove. “Mad love for all the Bitcoin freaks,” McCabe added in another tweet. A great number of bitcoiners welcomed McCabe into the space, and a few individuals told him that he was still in the early adoption phase of bitcoin.

The Tallinn and McCabe news follows a number of prominent executives getting into the cryptocurrency space and discussing the benefits of bitcoin in 2020. Executives like billionaire Stanley Druckenmiller, the ‘Bond King’ Jeffrey Gundlach, the well known fund manager Bill Miller, billionaire investor Paul Tudor Jones, and even the actor Kevin Hart jumped on the bitcoin wagon this year. Alongside this, the U.S. Senator, Cynthia Lummis, sees a lot of “promise” when it comes to the innovation provided by the crypto economy.

Even the traditional crypto naysayers are starting to discuss bitcoin in a more positive way. Former bitcoin doubter JPMorgan’s recent analysis shows institutional interest has been moving from gold exchange-traded funds (ETFs) to bitcoin. The infamous BTC hater, Nouriel Roubini (‘Dr. Doom’), admitted that BTC might be a store of value in a recent interview with Yahoo Finance. With the way things are going, it’s likely a whole lot more popular tech and investor luminaries will be joining the cryptocurrency revolution. And maybe some former haters as well.

Bitcoin Goes Mainstream With End of Dollar

Goldman, Citi See Dollar Sliding In 2021, Plunging As Much As 20% reports:

After Deutsche Bank flip-flopped on its view for the dollar…other banks have joined the bandwagon expecting a major drop in the world's reserve currency in the coming year. In a Friday note from Goldman's chief FX strategist Zach Pandal, he predicts that "depreciation in the broad Dollar can continue in 2021".

The article adds:

But if Goldman's forecast for a 6% drop in 2021 is aggressive, then Citi's prediction is outright bizarre: according to Citigroup FX strategist Calvin Tse, the dollar is likely to begin a drop of as much as 20% in 2021 should Covid-19 vaccines become widely distributed and help to revive global trade and economic growth. Quoted by Bloomberg, Tse said that "vaccine distribution we believe will check off all of our bear market signposts, allowing the dollar to follow a similar path to that it experienced from the early to mid-2000s" when the currency started a multi-year downturn.

Jeff Berwick, Canadian founder of The Dollar Vigilante, explains that the Fed has been destroying the dollar aggressively. Yet, many Americans assume the dollar will remain our currency. However, Are You Prepared For Imminent US Digital Dollar? points out that since the establishment of the Federal Reserve in 1913, the value of US dollar has declined so much that it is worth almost nothing now.

The Coming US Digital Dollar (Part 1): What it is, and Why it Matters by Dr. Garrick Hileman warns that the replacement of the US dollar by a digital dollar is now inevitable and imminent – possibly as early as January 1, 2021. Americans who are not prepared for this shift may be devastated financially.

Government Digital Currency: Why You Should Be TERRIFIED! explains that once the US digital dollar is introduced, it may no longer be possible to protect your savings. So, it warns that the time to shift to bitcoin and other cryptocurrencies is NOW – before the end of this year.

See the following articles for more information about bitcoin:

- Bitcoin is Going Mainstream Now

- Petrodollar To US Digital Dollar In 2021

- US Dollar Is Almost Dead -- What's Next?

- Bitcoin’s Sudden Acceptance As Global Finance Changes

- Why You Should Consider Getting Into Bitcoin Before 2021!

Film: Using Bitcoin To Facilitate Freedom and Innovation

Bitcoin Film | Cryptocurrency Documentary "Inside The Crypto-Kingdom" | Blockchain | Cryptomoney is a November 2020 film which begins with a discussion of “The Bitcoin Family” , the Dutch family of Didi Taihuttu whose mother was from Indonesia and whose father was from Holland.Didi made headlines around the world in 2017 when he sold his profitable business, his family house and cars, and even the children’s toys for Bitcoin, believing he’d be a multi-millionaire by 2020. With no bank accounts or possessions, and all their savings tied up in highly volatile cryptocurrencies, Taihuttu, 41, his wife and three children embarked on a world-wide adventure — a quest for a “decentralized, nomad, Bitcoin life,” as he described it. They embarked on a world tour to 40 countries to spread the word.

When Didi gave a talk to a huge audience in Lisbon, Portugal in 2018, he explained that he was very materialistic until his mother suddenly died at age 48 and his father later died at age 61. That woke him up to how short and precious life is and that it should not be focused on material values. After Did and his family embarked on their tour, the media began following their decentralized nomad life.

The film interviews Roger Ver, the first bitcoin investor, who explains that 200 years ago, the separation of church and state would have seemed inconceivable. His goal is to use bitcoin to facilitate a separation of money and government and later to separate society from government to free people to innovate in novel ways. He says now people who don’t want to participate in existing systems have a tool to opt out.

Ver says that a friend is planning to use Bitcoin Cash and other cryptos to set up a free society. The goal is to buy land in a country that will grant them sovereignty and set up a “non country”! Ver believes that a lot of digital nomads around the world would love to move to a place like that. An experiment is being set up in a poor part of Myanmar (Burma) to experiment with a society built on the blockchain.

The film explains that nature, which is the most complex and organized system, organizes itself very effectively without central control. The goal is to figure out how to organize our societies as nature is organized. The Seasteading Institute creates politically autonomous floating communities. Its book is called Seasteading: How Floating Nations Will Restore the Environment, Enrich the Poor, Cure the Sick, and Liberate Humanity from Politicians.

The film explains that humanity is at a fork in the road now. Either technology will be used to impose the most tyrannical system in history or it will be used to free and empower humanity as never before.

Origin and Purpose of Blockchain and Bitcoin

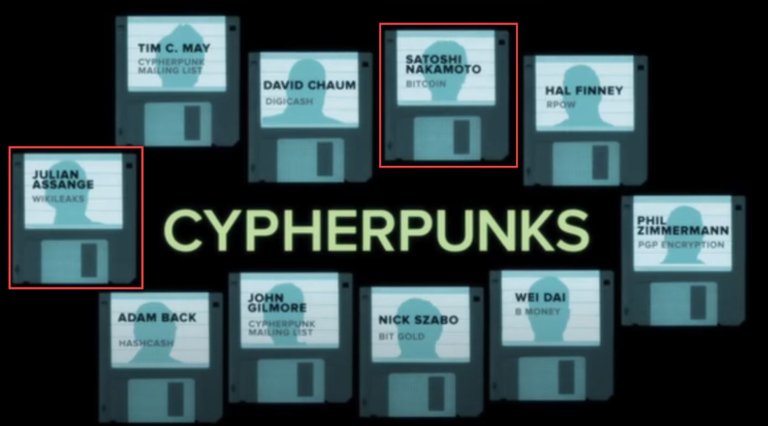

As the mainstream economy increasingly adopts bitcoin, other cryptocurrencies, and the blockchain on which they run, it’s important to remember the origin, goals, and principles on which bitcoin was founded. Cypherpunks are true pioneers, visionaries, and revolutionaries who have disrupted the global system in an attempt to make it fairer and more accountable. They are freedom fighters, fighting for freedom of information, truth, and accountability. They are fighting for humanity.

Banking on Bitcoin provides a comprehensive understanding of the origins of bitcoin. It says that bitcoin is beyond a currency. It is a monetary revolution! The cypherpunks who inspired the creation of bitcoin did not do it to make money, but to create a financial system and a better world. One of the cypherpunks was Julian Assange who later founded WikiLeaks which transformed the world of journalism and politics. He is paying a high price now for his courage and devotion to the truth.

In the 1990s, cypherpunks were exploring ideas about cryptography that laid the foundation for the blockchain and bitcoin. However, those ideas weren’t fully developed until after the 2008 financial meltdown. While Satoshi Nakamoto’s name was on the white paper that introduced bitcoin and the blockchain in 2008, no one knows who he is. The name may even be a pseudonym for a group.

The blockchain/bitcoin revolution sprang out of a desire to rescue the world from the banking and housing catastrophe that brought down the world economy. It is a catastrophe for which no American banks or bankers have been held accountable. In fact, they were rewarded with trillions of bailout dollars. “Bail-ins” stole billions more dollars from the accounts of bank customers in Cyprus. It was a world in which financial irresponsibility was not only not punished – but was vastly rewarded.

The goal of “DeFi” – decentralized finance – is to create a decentralized system for money. The blockchain on which the cryptocurrencies run is designed to cut out banks and other middlemen to ensure freedom and privacy as well as a currency that cannot be inflated. So, it is ironic to see banks and other mainstream institutions now embrace this revolution! The blockchain and bitcoin have so redefined the rules that everyone must adopt their standards to stay relevant!

Bitcoin Films on Amazon Prime

The Amazon Prime videos below are free for members and are an easy, fun way to learn a lot quickly.

The Rise and Rise of Bitcoin compares the blockchain and bitcoin to the rise of the internet. It is a must-see film which shows that the technology behind bitcoin can revolutionize much more than money. The 2019 Cryptocurrency Explained is one of the quickest introductions.

Cryptopia: Bitcoin, Blockchains, and The Future of the Internet is a 2020 film which says the blockchain on which bitcoin is built is bigger than the Internet, the Iron Age, the Renaissance, and the Industrial Revolution! It describes bitcoin as one of the most exciting inventions in history. It says, “If you don’t think bitcoin is already changing the world’s concept of money, you haven’t been paying attention.” The film discusses some of the problems with “alt coins” – cryptocurrency other than bitcoin.

Bitcoin Beyond The Bubble says that the blockchain and bitcoin are going to change everything including voting. It says the technology is really going to revolutionize Latin America, Africa, South East Asia, etc.

The Bitcoin Story discusses the clash of ideals as bitcoin goes mainstream. Bitcoin Gospel asks: “Is bitcoin the blueprint for a bankless currency? It exists, and some people consider it to be the digital version of gold: bitcoin.”

Mastering Bitcoin For Beginners is a free 2018 series with 10 Episodes in Season 1 on Amazon Prime.

How To Buy, Store, and Use Bitcoin

The number of Americans invested in cryptocurrencies almost doubled from 7.95% in 2018 to 14.4% in 2019, an increase of 81% in one year. The easiest way to get started is to ask someone who has invested in bitcoin for help. It’s remarkable how easy it is then. Finder’s Guide to Cryptocurrencies provides key terms. The free 7-day online Bitcoin Crash Course continues to provide information after the first week.

You need a “wallet” to buy, store, and sell your bitcoins and there are several kinds of wallets. Coinbase is an exchange that provides an easy wallet to start with. If you buy $100 of bitcoins with this link, you will get $10 in bitcoins. However, your funds will not be as secure online as in a hardware wallet. In 2019, a record-breaking $4 billion was stolen from cryptocurrency exchanges, underscoring just how critical it is for you to control your own assets.

Hardware Wallets Explained, Reviewed and Compared is a good guide. Bitcoin Cold Storage: A Comprehensive Guide discusses pros and cons of various online (hot) and hardware (cold) wallets. BEST Crypto Wallets 2020: Top 5 Picks explains the importance of choosing the right wallet for your goals. Its top recommendation is the Ledger Nano X hardware wallet. It is the most secure wallet and allows you to trade on the go. See How To Use A Bitcoin Hardware Wallet: Ledger Nano X and the unboxing tutorials. A back-up pack provides extra security. The videos stress the importance of buying from Ledger. However, Amazon has several helpful videos about the Ledger Nano X. It also sells a case for the Nano S which is also good for storing the Nano X.

After you get a wallet, you can buy cryptocurrencies. It is not necessary to buy a whole bitcoin – which costs about $17,500 now. See the current price at CoinMarketCap. The satoshi is the smallest unit of the bitcoin recorded on the blockchain. It is a one hundred millionth of a bitcoin (0.00000001 BTC). So, one bitcoin is 100,000,000 satoshis. The unit was named for Satoshi Nakamoto who is credited with creating the blockchain and introducing bitcoin in 2009.

If you use a private online wallet like Jaxx.io, secure your 12-word Back Up Phrase! If you lose it, you will lose all your cryptocurrencies in that wallet! There will be no way to recover your password or your money! So, keep a printed copy in your safe or another secure place you will remember. Jaxx Wallet Beginner’s Guide. DeFi vs CeFi: How DeFi Measures Up discusses some of the risks.

Christopher Giancarlo, the former chairman of the Commodity Futures Trading Commission (CFTC) who goes by the name “Crypto Dad”, provides very helpful YouTube videos on the use of Coinbase and the Ledger hardware wallets to store bitcoin. His Crypto Basics Live Q&A Hour is on YouTube every Tuesday morning from 9-10 AM ET. The Wall Street Journal reports: “J. Christopher Giancarlo, who stepped down as chairman of the Commodity Futures Trading Commission last year, said he was creating the nonprofit Digital Dollar Foundation to study converting the dollar into a fully electronic currency based on blockchain, the technology that underpins bitcoin.” The article contains a very informative video about how cryptocurrencies are changing the world now.

The purse.io site offers a minimum 5% discount for purchases on Amazon made with bitcoin (BTC) or bitcoin cash (BCH). When you sign up, you get $5 in bitcoins with your first purchase of $100. How To Invest in a Bitcoin IRA: The 5 Best Crypto IRAs says you can shelter up to $7,000 tax-free in a bitcoin IRA each year. You can use Coin Stats to track your portfolio. Join the Counter Markets Newsletter to keep up-to-date with the crypto world. You save 40% if you pay with a cryptocurrency.

Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex, and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. The author may have holdings in the cryptocurrencies discussed

Top image: Head Topics

Subscribe to Activist Post for truth, peace, and freedom news. Send resources to the front lines of peace and freedom HERE! Follow us on SoMee, HIVE, Parler, Flote, Minds, MeWe and Twitter.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Excellent collation of information covering many different aspects.

Since last run security has tightened new ideas implemented perhaps this is why more in banking sectors are looking at securing themselves.

@tipu curate

Upvoted 👌 (Mana: 11/22) Liquid rewards.

Big Players buying the pot.. Good thing for a bullish movement, worst thing for the idea behind crypto...

i like to upvote this :D but will do with a comment :)